Dhunseri Tea & Industries Ltd is engaged in cultivation, manufacture and sale of tea through its estates located in Assam, India and parts of Africa.

Financial Results:

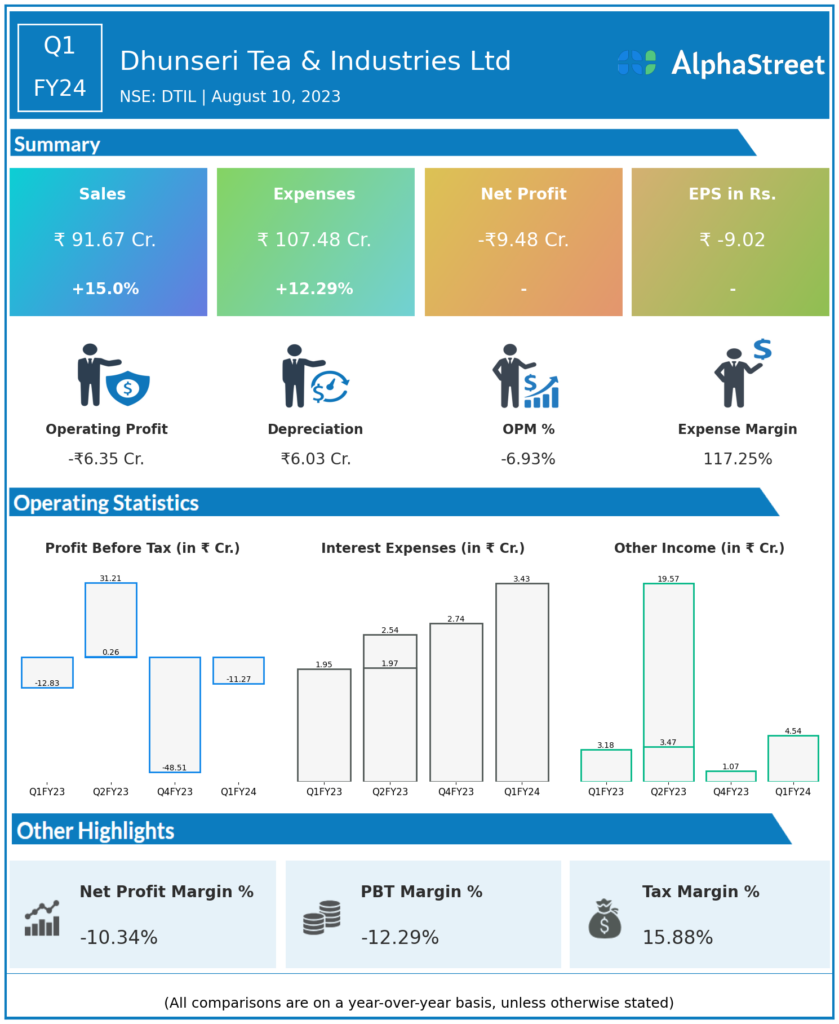

Dhunseri Tea & Industries Ltd reported Revenues for Q1FY24 of ₹91.67 Crores up from ₹79.71 Crore year on year, a rise of 15.0%.

Total Expenses for Q1FY24 of ₹107.48 Crores up from ₹95.72 Crores year on year, a rise of 12.29%.

Consolidated Net Profit of -₹9.48 Crores from -₹8.72 Crores in the same quarter of the previous year.

The Earnings per Share is -₹9.02, from -₹8.30 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.