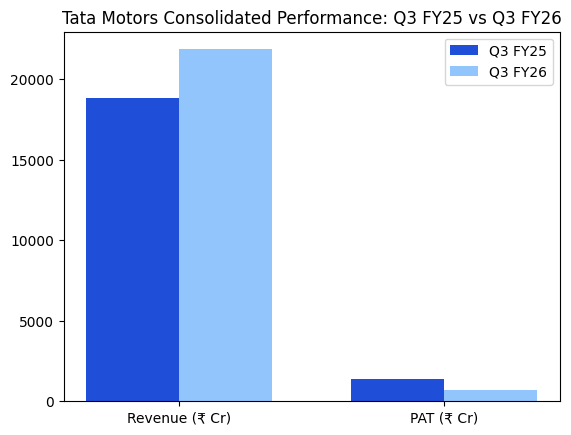

Tata Motors Limited (NSE: TMCV) reported its consolidated financial results for the third quarter ended December 31, 2025, showing an increase in revenue alongside a contraction in net profit.

Latest Quarterly Results

The company’s consolidated revenue for the third quarter stood at ₹21,847 crore, representing a 16% increase compared to ₹18,819 crore in the same period last year. Consolidated profit after tax (PAT) was recorded at ₹705 crore, a decrease of 47.9% from the ₹1,355 crore reported in the prior-year quarter.

Exceptional items impacted consolidated financials by ₹1.6K crore during the period. These items included costs associated with the New Labor Code (₹603 crore), the company demerger (₹962 crore), and acquisition-related expenses (₹82 crore).

Segment Highlights

Commercial Vehicles (CV) Revenue for the CV segment reached ₹21,533 crore, a 17% increase year-over-year. EBITDA for the segment was ₹2,724 crore, up 19% from ₹2,291 crore in the prior-year period. The EBITDA margin stood at 12.7%, an expansion of 30 basis points. EBIT margins for the segment reached 10.6%. CV wholesales reached 116.8K units, a 20% increase.

Others Revenue from the “Others” segment, which includes insurance broking services, was ₹257 crore. Segment results before interest and tax for this category showed a loss of ₹22 crore for the quarter.

Full-Year Results Context

For the nine-month period (April to December 2025), consolidated revenue was ₹57,757 crore, reflecting a directional growth of 6% over the ₹54,453 crore reported for the same period in the previous year. Consolidated profit after tax for the nine-month period contracted to ₹1,236 crore, compared to ₹1,855 crore in the prior-year period.

Business & Operations Update

Tata Motors launched 17 next-generation trucks during the quarter and introduced the Azura series for the intermediate, light, and medium commercial vehicle (ILMCV) segment. The company unveiled a Euro 6 range of vehicles tailored for the Middle East and North Africa regions. Operational developments included the demerger of the commercial vehicles business from Tata Motors Passenger Vehicles Ltd (TMPVL), which became effective on October 1, 2025. Regulatory changes included the notification of the Extended Producer Responsibility (EPR) for End of Life of Vehicles in January 2025, effective from April 1, 2025.

M&A or Strategic Moves

The Board of Directors approved a composite scheme of amalgamation to merge wholly owned subsidiaries TMF Holdings Limited and TMF Business Services Ltd with TML. Additionally, the company announced an agreement to acquire Iveco Group N.V.’s common shares through an all-cash voluntary tender offer for approximately ₹38,200 crore (€3.8 billion). The transaction is subject to regulatory approvals and the separation of Iveco’s defense business.

Guidance & Outlook

Management expects demand to strengthen in the fourth quarter of FY26. Key industry drivers for 2026 include government infrastructure spending and expansion in end-use sectors. In the CV Passenger segment, the company anticipates initiated deliveries against a government order book exceeding 6,000 units.

Performance Summary

Consolidated revenue increased 16% to ₹21,847 crore. Net profit for the period contracted to ₹705 crore. The Commercial Vehicles segment reported a 17% revenue increase and 10.6% EBIT margin. Total investment spending for the nine-month period reached approximately ₹2,000 crore.