LT Foods Ltd. is a leading Indian-origin global FMCG company in the food and consumer goods space. It is a leading player globally in the specialty Rice and rice-based foods business for over the last 70 years.

Q3 FY26 Earnings Results

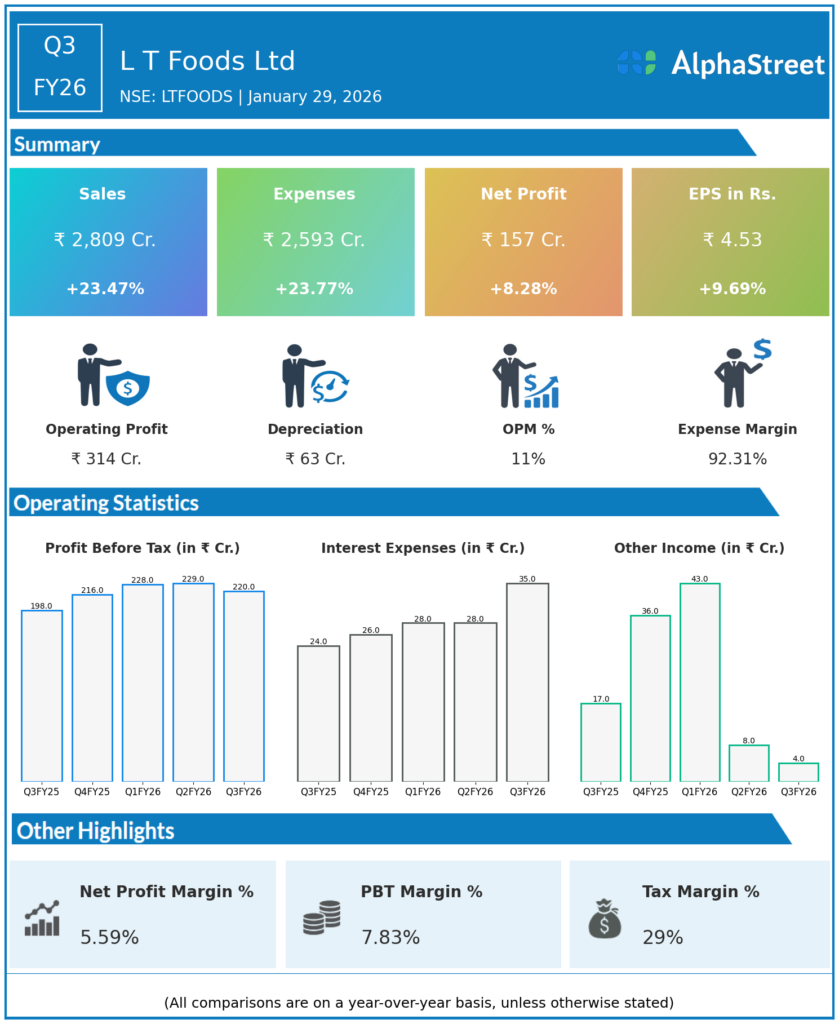

- Revenue from Operations: Consolidated ₹2,812 crore, up 23.6% YoY vs ₹2,275 crore, marking the highest-ever quarterly sales; growth was broad-based across basmati, organic foods, and ready-to-cook/heat, with normalized growth 13% excluding US tariff impact.

- EBITDA: Around ₹317 crore, up 20% YoY; EBITDA margin about 11.3% (−20 bps YoY) as strong volume-led gross profit (+24% YoY to ₹963 crore) was partially offset by higher input and other operating costs.

- PAT: Net profit ₹157 crore, up 9.8% YoY vs ₹143 crore, PAT margin 5.6% (−80 bps YoY), reflecting robust topline but some pressure from tariffs and input cost inflation; quarterly cash and cash equivalents reached a record ₹613 crore, supporting balance sheet strength.

- Other key metrics: 9M FY26 consolidated revenue ₹8,085 crore (+24% YoY), EBITDA ₹936 crore (+20% YoY), PAT ₹490 crore (+9% YoY), with PAT margin narrowing to 6.1% from 6.9%; basmati and other specialty rice business grew 26% YoY in 9M, while organic foods and ingredients grew 15% YoY, supported by brand investments and global distribution.

Management Commentary & Strategic Decisions

- Management highlighted that Q3 and 9M performance demonstrates a resilient and robust business model, with disciplined execution and focus on quality/consumer relevance enabling healthy growth despite a dynamic global environment and tariff overhang in the US market.

- Strategic moves: Board declared an interim dividend of ₹1 per share in conjunction with Q3 results, and reiterated focus on premiumization within basmati, scaling organic and ready-to-cook/heat portfolios, and leveraging global distribution across 80+ countries to mitigate regional policy risks like US tariffs.

- The company emphasised continued brand investments and marketing to deepen consumer trust across markets, while working to manage input-cost pressures through operational efficiencies and mix improvement; management also pointed to healthy balance sheet metrics such as net debt-equity of 0.27 and ROCE around 20.3% as comfort for sustaining growth investments.

Q2 FY26 Earnings Results

- Revenue from Operations: Consolidated revenue ₹2,772 crore, up about 31% YoY vs ₹2,134 crore and up 12% QoQ, representing the then highest quarterly revenue, driven by strong demand across domestic and international markets and particularly strong traction in the premium basmati portfolio.

- EBITDA: ₹316 crore, up 24% YoY vs ₹255 crore; PBDIT (excl. other income) about ₹310 crore with operating margin 11.2% (vs 10.9% in Q2 FY25 and 10.8% in Q1 FY26), showing only modest margin expansion as elevated employee and interest costs absorbed part of the operating leverage.

- PAT: Net profit ₹164 crore, up around 10% YoY vs ₹151 crore but down 2.7% QoQ, with PAT margin 6.0%; management commentary framed this as solid profitability given strong revenue growth and ongoing cost pressures.

- Other key metrics: H1 FY26 consolidated revenue ₹5,230 crore (+24.8% YoY) and PAT ₹332.4 crore (+10.2% YoY); H1 operating margin 10.98% (slightly below 11.26% in H1 FY25), underscoring that margin compression remained a theme despite strong topline momentum.

Management Commentary Q2

- Management noted that 31% revenue growth in Q2 FY26 underlines the strength of LT Foods’ premium brand portfolio and global distribution network, even as they acknowledged near-term margin pressure from costs across the value chain that must be addressed through operational efficiencies.

- Strategic moves: Focus areas included deepening presence in premium basmati and packaged foods, continuing brand-building in core markets, and optimizing working capital and sourcing to protect margins; Q2 set up a strong base heading into festive season and Q3, with management positioning the company for sustained double-digit revenue growth while gradually improving profitability mix.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.