IFB Industries Limited originally known as Indian Fine Blanks Limited started its operations in India in 1974 in collaboration with Heinrich Schmid AG of Switzerland. It is engaged in the business of manufacturing diverse parts and accessories for motor vehicles etc. and home appliances products.

Financial Results:

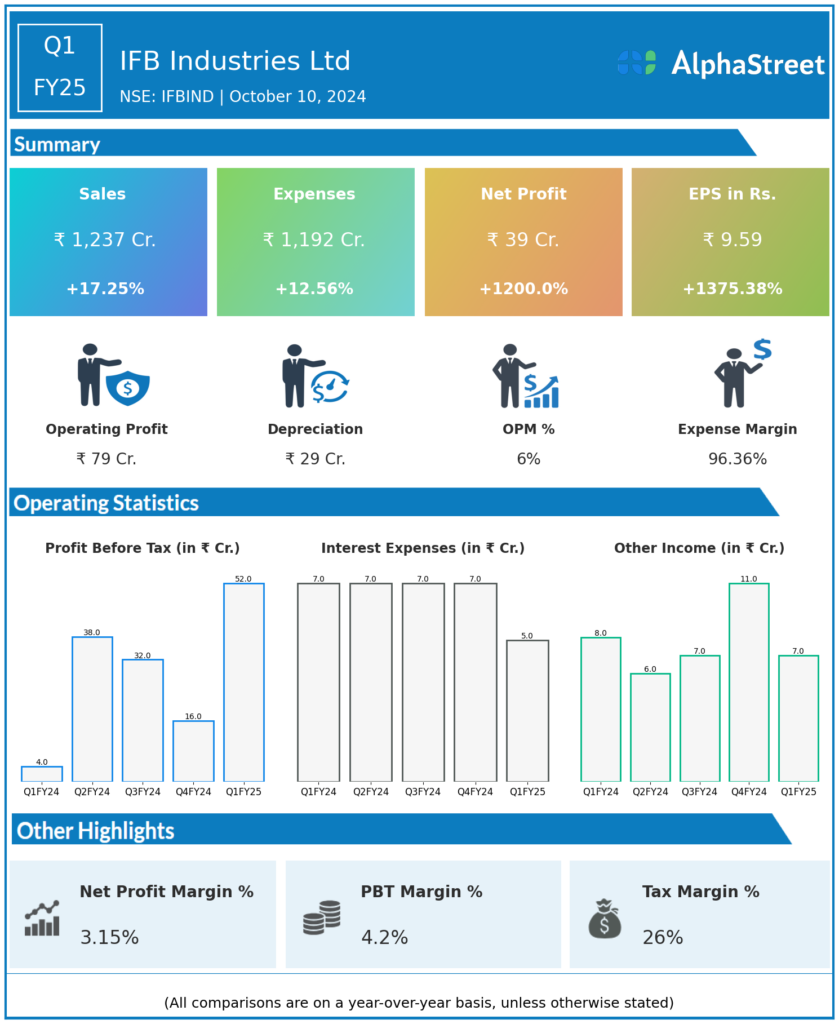

IFB Industries Ltd reported Revenues for Q1FY25 of ₹1,237.00 Crores up from ₹1,055.00 Crore year on year, a rise of 17.25%.

Total Expenses for Q1FY25 of ₹1,192.00 Crores up from ₹1,059.00 Crores year on year, a rise of 12.56%.

Consolidated Net Profit of ₹39.00 Crores up 1200.0% from ₹3.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹9.59, up 1,375.38% from ₹0.65 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.