Havells India Limited is a leading Fast Moving Electrical Goods (FMEG) Company and a major power distribution equipment manufacturer with a strong global presence. It enjoys enviable market dominance across a wide spectrum of products, including Industrial & Domestic Circuit Protection Devices, Cables & Wires, Motors, Fans, Modular Switches, Home Appliances, Air Conditioners, Electric Water Heaters, Power Capacitors, Luminaires for Domestic, Commercial and Industrial Applications.

Financial Results:

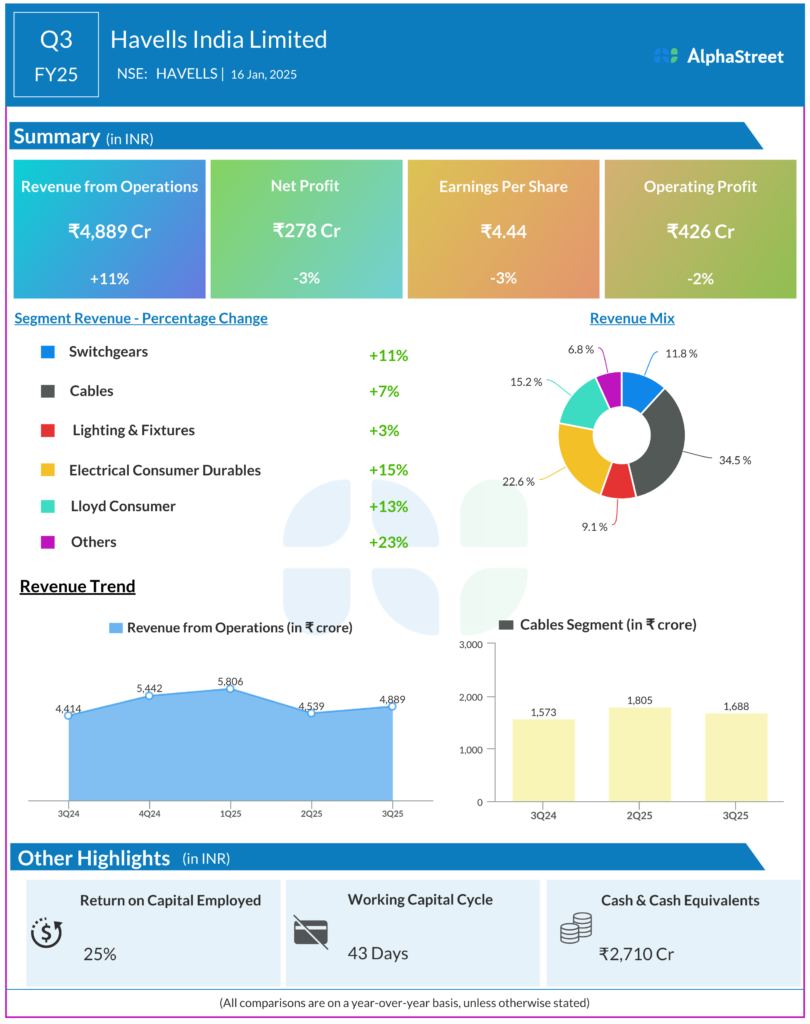

Havells India Ltd reported Revenues for Q3FY25 of ₹4,889.00 Crores up from ₹4,414.00 Crore year on year, a rise of 10.76%.

Total Expenses for Q3FY25 of ₹4,575.00 Crores up from ₹4,079.00 Crores year on year, a rise of 12.16%.

Consolidated Net Profit of ₹278.00 Crores down 3.47% from ₹288.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹4.44, down 3.27% from ₹4.59 in the same quarter of the previous year.