Shoppers Stop Ltd. is the nation’s leading premier retailer of fashion and beauty brands established in 1991.

It has 800+ Brands under its portfolio and 271 Stores spread across 50 cities in India as of 31st Dec 2022.

Financial Results:

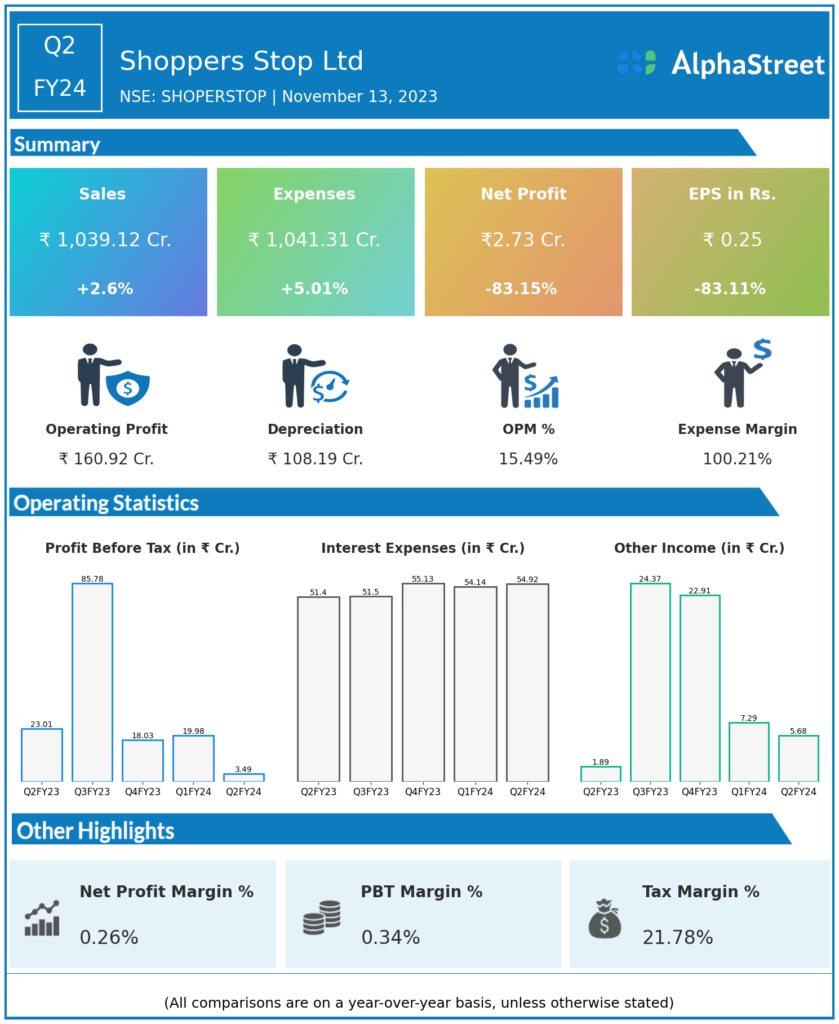

Shoppers Stop Ltd reported Revenues for Q2FY24 of ₹1,039.12 Crores up from ₹1,012.74 Crore year on year, a rise of 2.6%.

Total Expenses for Q2FY24 of ₹1,041.31 Crores up from ₹991.62 Crores year on year, a rise of 5.01%.

Consolidated Net Profit of ₹2.73 Crores down 83.15% from ₹16.20 Crores in the same quarter of the previous year.

The Earnings per Share is ₹0.25, down 83.11% from ₹1.48 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.