Incorporated in 1994, Tata Technologies Limited is a global engineering services company offering Product Development and Digital Solutions.

Financial Results:

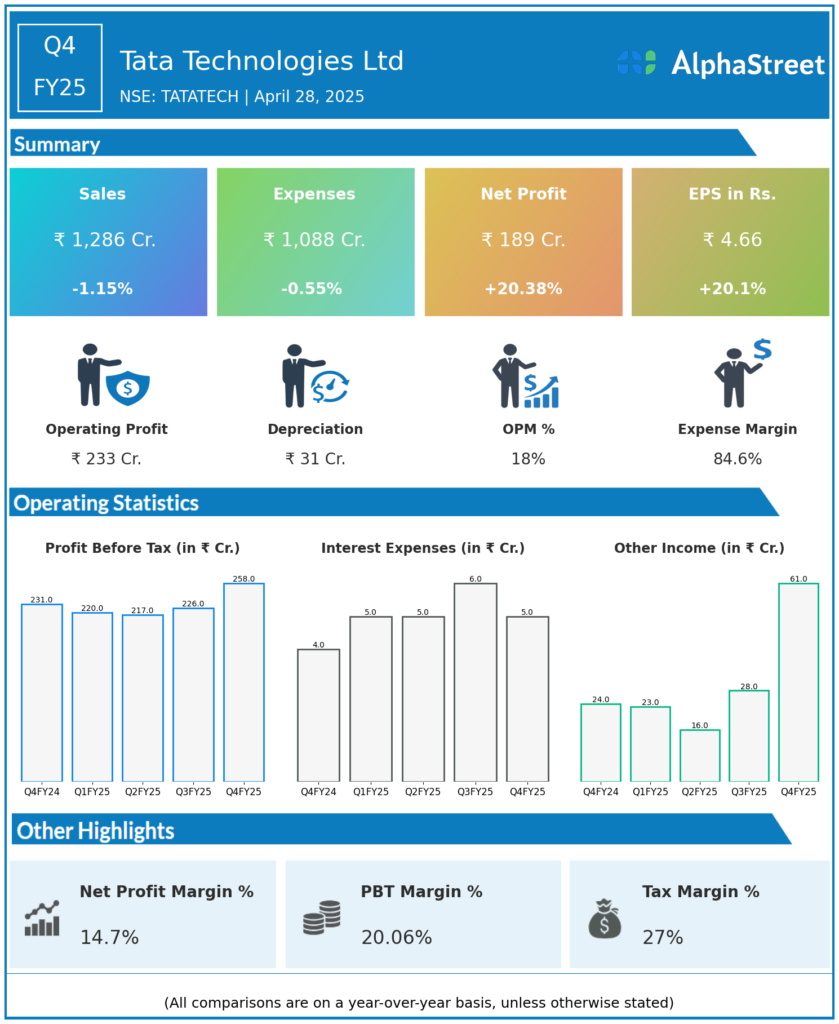

Tata Technologies Ltd reported Revenues for Q4FY25 of ₹1,286.00 Crores down from ₹1,301.00 Crore year on year, a fall of 1.15%.

Total Expenses for Q4FY25 of ₹1,088.00 Crores down from ₹1,094.00 Crores year on year, a fall of 0.55%.

Consolidated Net Profit of ₹189.00 Crores up 20.38% from ₹157.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹4.66, up 20.10% from ₹3.88 in the same quarter of the previous year.