Incorporated in April 1995, Premier Energies Limited specializes in manufacturing integrated solar cells and solar panels. Its product portfolio includes solar cells, solar modules, monofacial and bifacial modules, as well as EPC and O&M solutions.

Q2 FY26 Earnings Results (Consolidated)

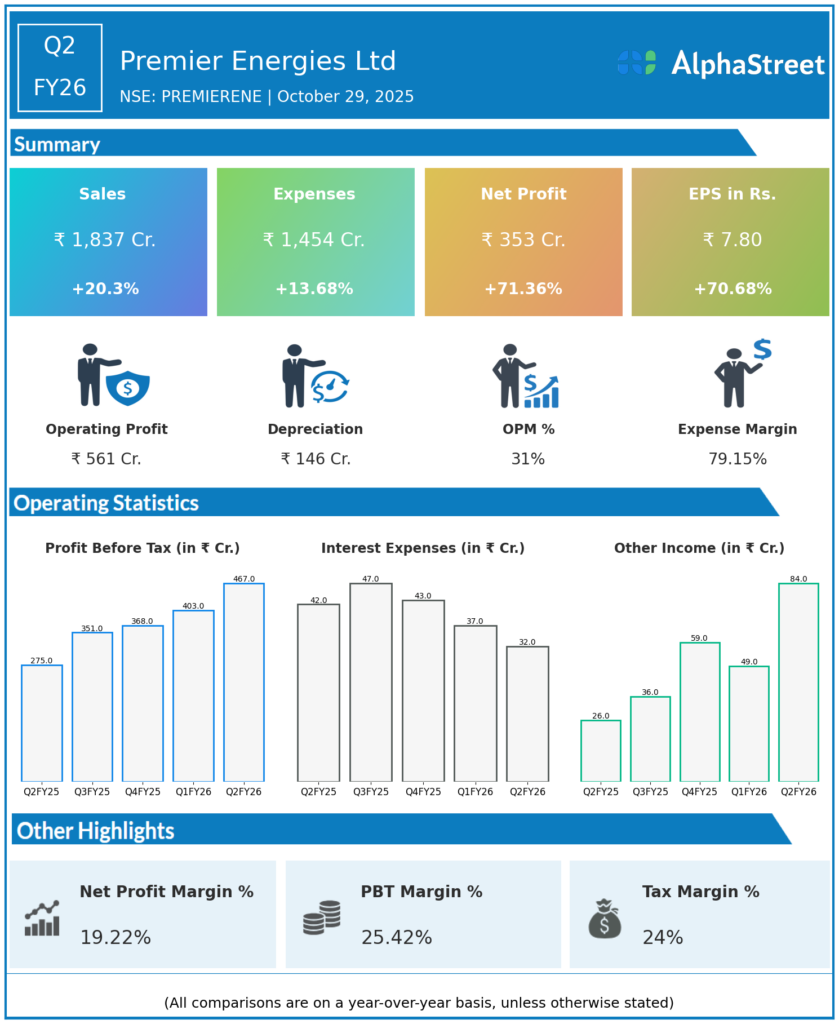

Total Income: ₹1,837 crore, up 20.3% YoY from ₹1,527 crore in Q2 FY25, and up 2.77% QoQ from ₹1,869.52 crore in Q1 FY26.

Net Profit (PAT): ₹353.44 crore, up 71.62% YoY from ₹205.95 crore in Q2 FY25, and up 14.83% QoQfrom ₹307.79 crore in Q1 FY26.

Earnings Per Share (EPS): ₹7.80, up 38.18% YoY, and up 15.52% QoQ.

Operating EBITDA: ₹561 crore, up 47.40% YoY, with operating margin improving from 25% to 30.53%.

Half Year Ended FY26: Total income ₹3,790.89 crore (up 17.64% YoY), Net profit ₹661.23 crore (up 63.63% YoY), EPS ₹14.77 (up 31.76% YoY).

Cash Profit (PAT + Depreciation): Strong operating cash flow aiding balance sheet strength.

Defence Orders: Secured Rs 430 crore defence order to supply explosives and initiation of new defence ammunition programs.

Diversified Portfolio: Strong performance from commercial explosives and R&D based product lines.

Expansion Plans: Expanding manufacturing and defense product lines, including HEAP/ HEDP ammunition ready for production.

Management Commentary & Strategic Highlights

-

Premier Explosives management emphasized strong momentum in export volumes and increasing high-margin defence product deployment.

-

Increased government and paramilitary business expected to boost growth prospects in FY26.

-

Strategic focus continues on broadening the client base for commercial explosives nationally and internationally.

-

Robust order book and healthy operating cash flow expected to provide flexibility for expansions.

-

The company noted improvements in operational efficiencies and cost reduction measures contributing to margin expansion.

-

Management anticipates production and supply of new defense ammunition systems to commence soon, driving long-term growth.

Q1 FY26 Earnings Results

Total Income: ₹1,869.52 crore, up 12% YoY.

Net Profit (PAT): ₹307.79 crore, up 55% YoY from ₹198 crore.

EPS: ₹6.83.

Operating EBITDA: ₹500 crore approx, with healthy margin expansionYoY.

Commercial Explosives: Continued superior growth in domestic industrial explosives sales contributing to growth.

Defence Products: Finalized R&D trials and pre-production for defense ammo components with DRDO collaboration

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.