Established in the year 1984 and a part of $1000 million Aarti Group of Industries, Aarti Drugs Ltd. (ADL) is engaged into manufacturing and selling Active Pharmaceutical Ingredients (API’s), Pharma Intermediates, Specialty Chemicals as well as Formulations.

Financial Results:

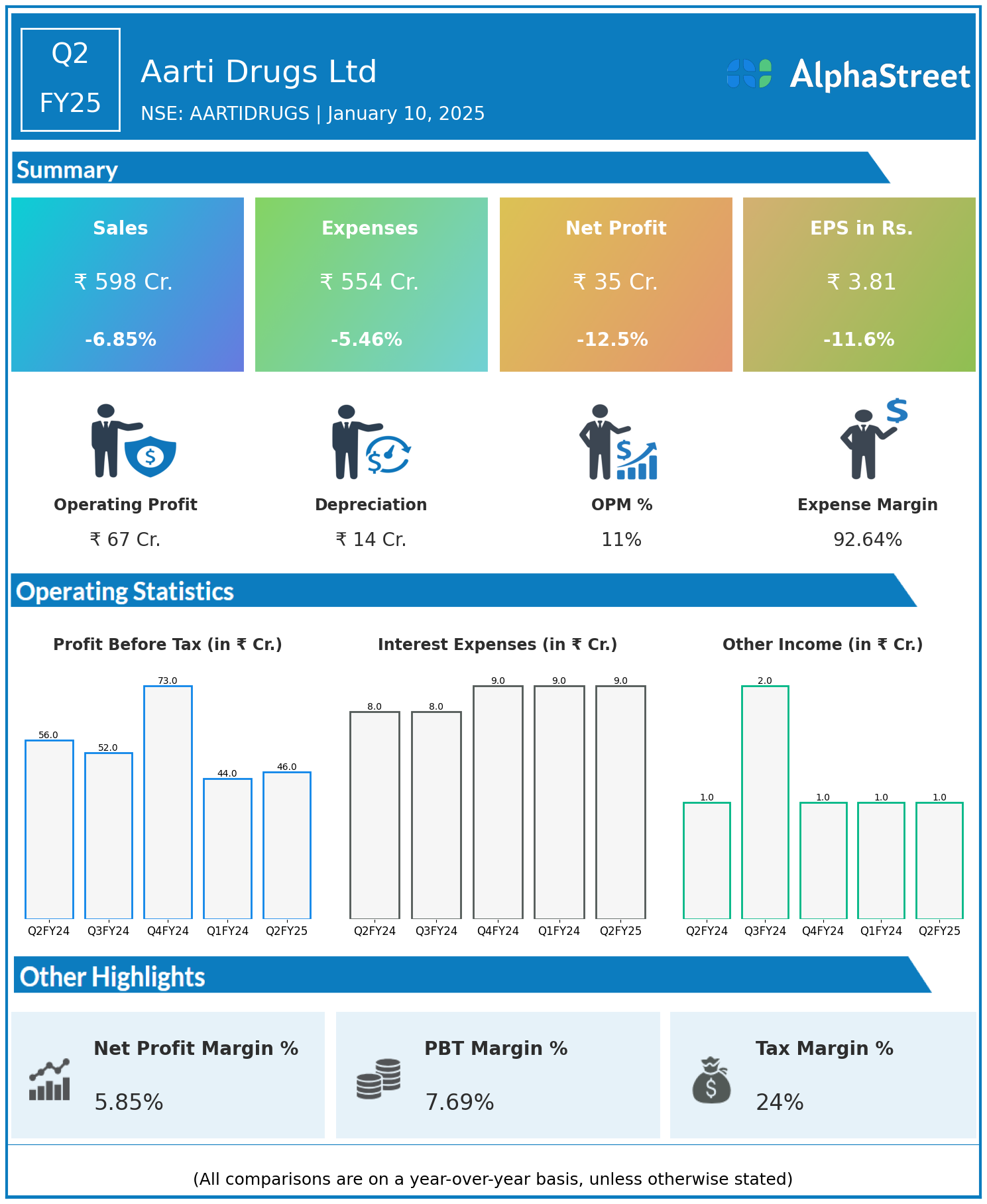

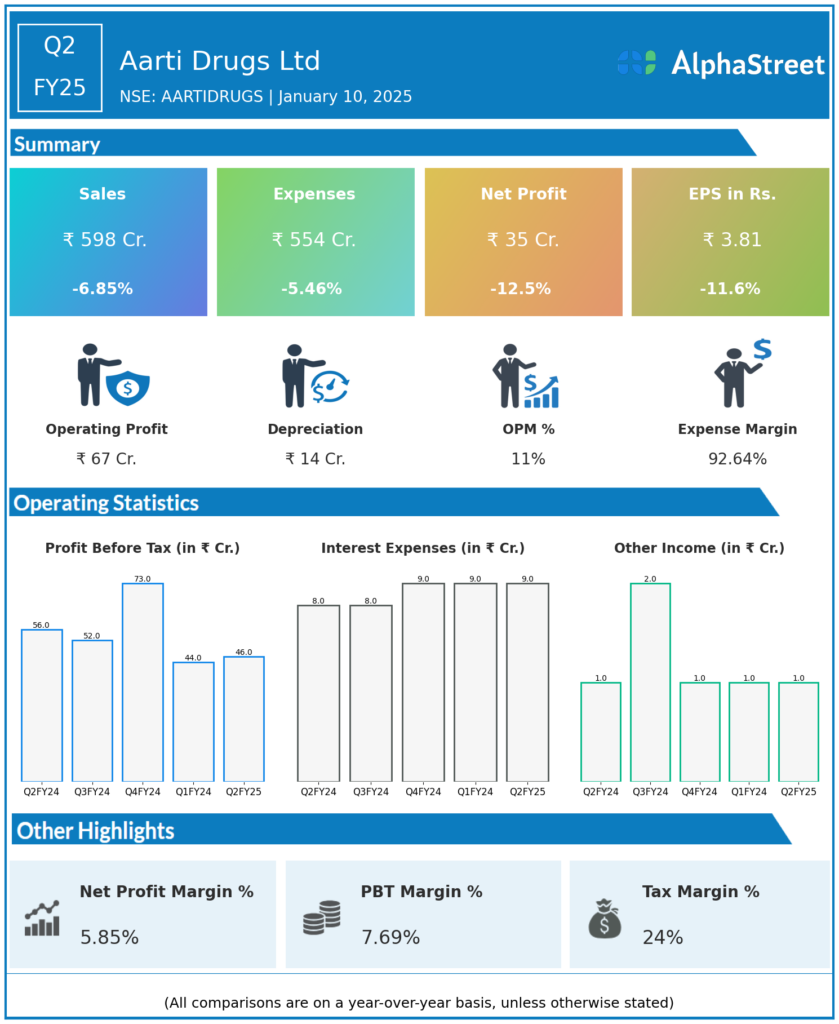

Aarti Drugs Ltd reported Revenues for Q2FY25 of ₹598.00 Crores down from ₹642.00 Crore year on year, a fall of 6.85%.

Total Expenses for Q2FY25 of ₹554.00 Crores down from ₹586.00 Crores year on year, a fall of 5.46%.

Consolidated Net Profit of ₹35.00 Crores down 12.5% from ₹40.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹3.81, down 11.60% from ₹4.31 in the same quarter of the previous year.