IHCL is one of India’s leading hospitality companies. IHCL and its subsidiaries comprise diversified portfolio across luxury, upscale/upper upscale and lean luxury/midscale segments. IHCL’s operations are spread across four continents, 12 countries and over 100 cities.

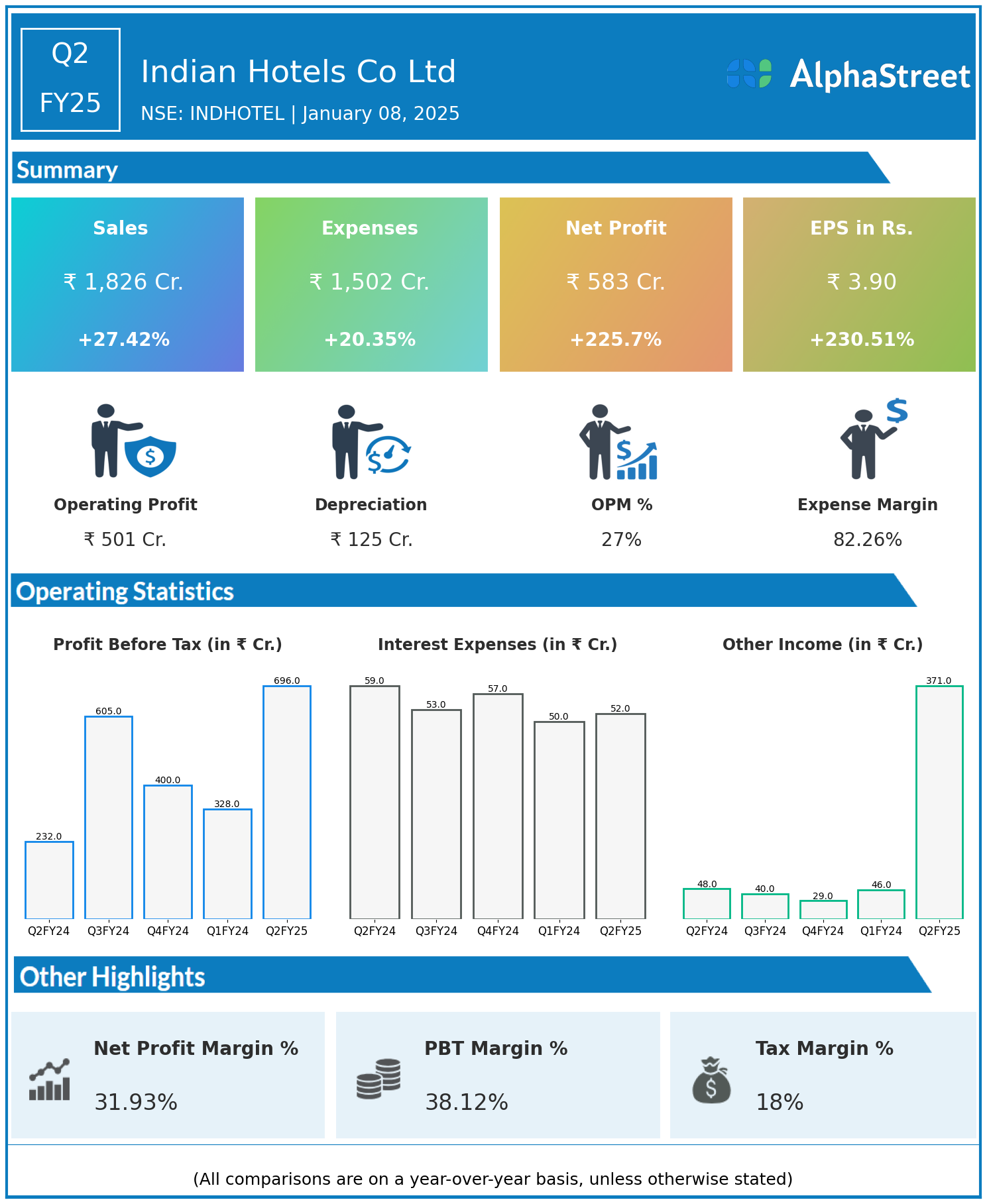

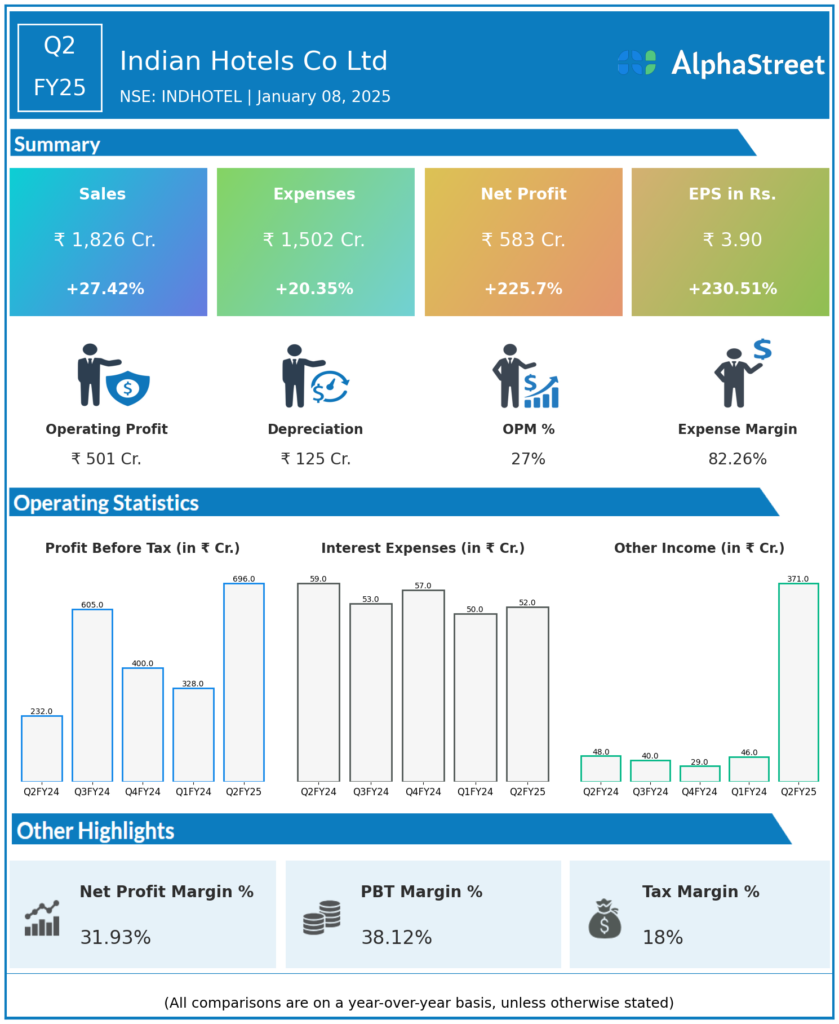

Financial Results:

Indian Hotels Co Ltd reported Revenues for Q2FY25 of ₹1,826.00 Crores up from ₹1,433.00 Crore year on year, a rise of 27.42%.

Total Expenses for Q2FY25 of ₹1,502.00 Crores up from ₹1,248.00 Crores year on year, a rise of 20.35%.

Consolidated Net Profit of ₹583.00 Crores up 225.7% from ₹179.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹3.90, up 230.51% from ₹1.18 in the same quarter of the previous year.