Indegene Ltd (NSE:INDGN), a life sciences services firm reported more than 30% year-on-year revenue growth for the December quarter, crossing the $100 million quarterly revenue mark for the first time, as strong client expansion and large deal wins boosted performance.

Revenue growth hits record level

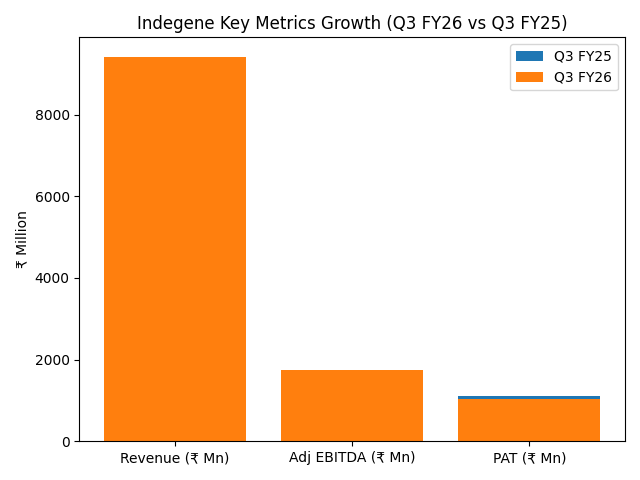

- Indegene reported revenue from operations of 9,421 million rupees ($106.1 million) for the quarter ended Dec. 31, 2025, marking 30.8% year-on-year growth and 17.1% sequential growth. This was the first time the life sciences services company crossed the $100 million mark in a single quarter.

Profitability resilient despite acquisition costs

- Adjusted EBITDA rose 15.7% year-on-year to 1,747 million rupees, while the adjusted EBITDA margin improved to 18.5%, up 30 basis points from the previous quarter.

- Reported profit after tax was 1,026 million rupees, broadly flat sequentially and lower than a year earlier due to one-time expenses and higher non-cash amortization related to recent acquisitions. The company said these impacts are temporary and expects margins to strengthen as integration synergies are realized.

Client expansion and large deal wins

- Customer relationships deepened during the quarter, with three of the company’s top five clients now generating more than $25 million in annual revenue each. Indegene also increased the number of $1 million-plus annual revenue clients to 52.

- The company secured multiple marquee deals, including two contracts each exceeding $10 million annual contract value across five work orders, and another exceeding $5 million annual contract value with $20 million total contract value across two work orders. These wins focus on combining execution capabilities with AI-led transformation of client operations.

Productivity gains from technology and AI

- Revenue per employee crossed $70,000 on an annualized basis, which the company described as the highest in the industry. Management attributed this to technology and AI-driven productivity improvements that allow scaling without proportional headcount growth.

Strategic acquisitions strengthen capabilities

- During the quarter Indegene completed the acquisitions of BioPharm in the United States and Warn & Co. in the United Kingdom. These additions expand the company’s omnichannel, consulting and domain expertise in life sciences commercialization and are expected to contribute to higher-value services over time.

Healthy balance sheet supports growth

- Even after acquisition-related outflows, the company reported cash and investments of 13,954 million rupees, supported by ongoing operating cash generation. Management said this financial strength provides flexibility for further capability building and expansion.

Outlook for sustained profitable growth

Indegene said the combination of strong deal momentum, deeper top-client relationships and integration of the new businesses positions it for continued profitable growth. Serving global biopharma companies across clinical, medical and commercial functions, the firm expects rising demand for AI-enabled and data-driven commercialization services to drive further scale and earnings expansion.