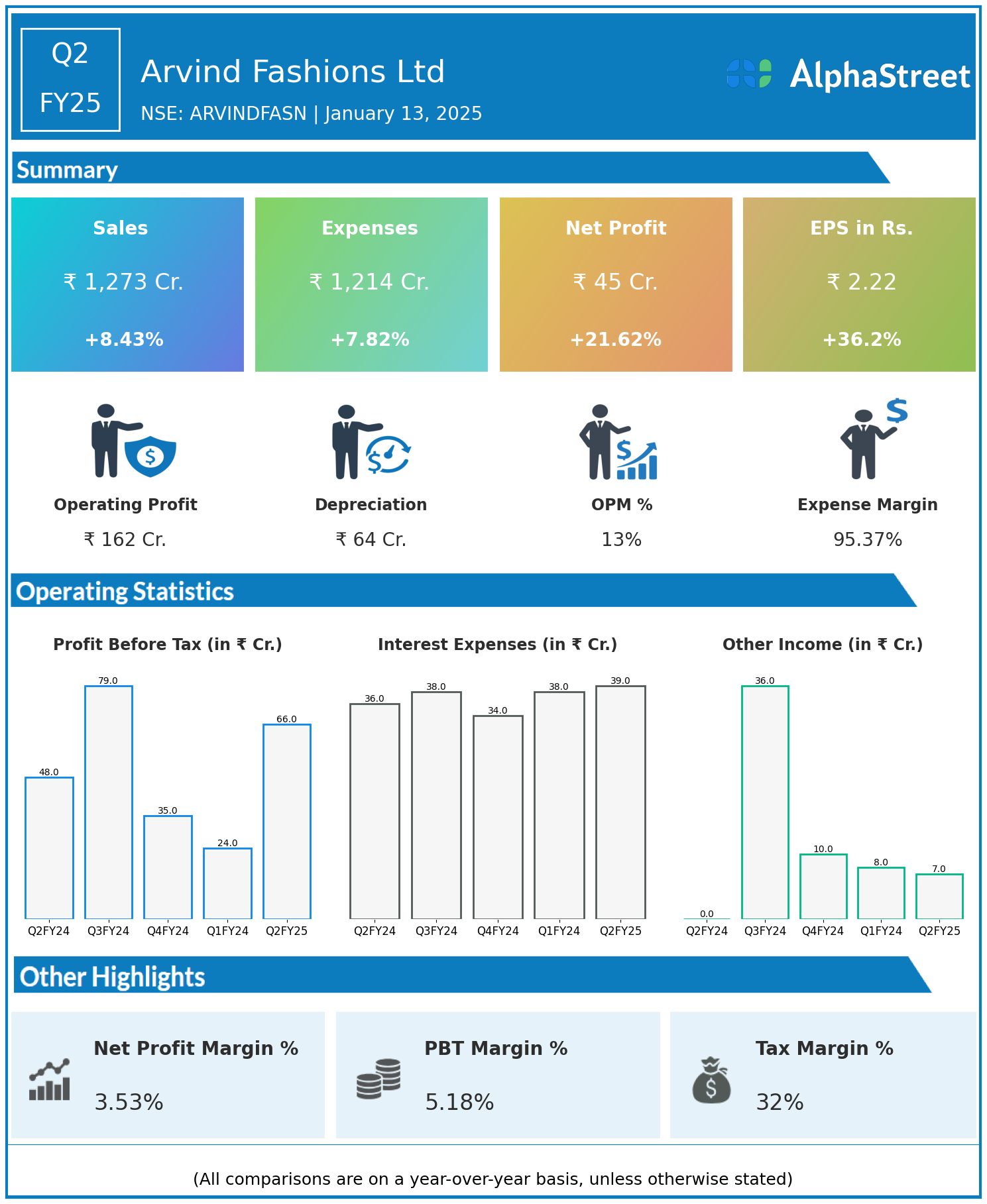

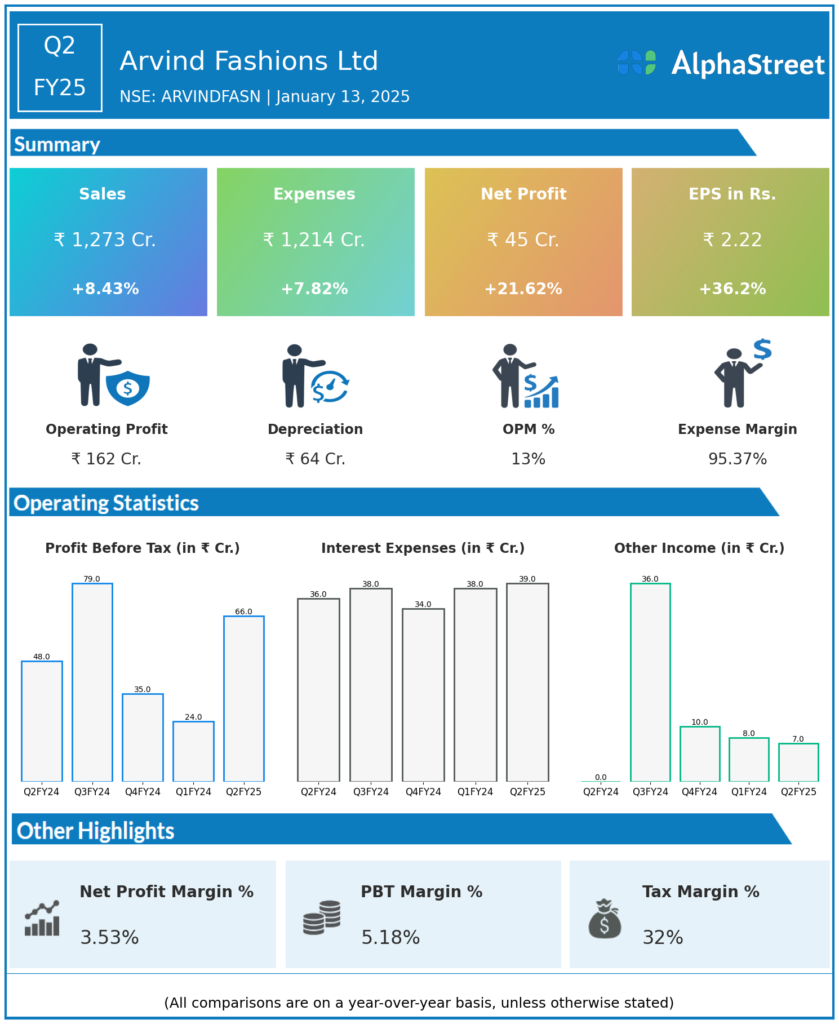

Arvind Fashions Ltd operates in the branded apparels, beauty and footwear space. It has a portfolio of several owned and licensed global brands across different segments.

Financial Results:

Arvind Fashions Ltd reported Revenues for Q2FY25 of ₹1,273.00 Crores up from ₹1,174.00 Crore year on year, a rise of 8.43%.

Total Expenses for Q2FY25 of ₹1,214.00 Crores up from ₹1,126.00 Crores year on year, a rise of 7.82%.

Consolidated Net Profit of ₹45.00 Crores up 21.62% from ₹37.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹2.22, up 36.20% from ₹1.63 in the same quarter of the previous year.