Sika Interplant Systems Limited (BSE:523606) is a subsidiary of Sika AG, a Swiss multinational corporation, that operates in four main areas: engineering, manufacturing, projects and systems integration, and maintenance, repair, and overhaul. The majority of their business is focused on serving the Aerospace, Defence & Space and Automotive sectors. Sika offers a combination of design, development, manufacturing, assembly, testing, certification, supply, integration of systems, and implementation of projects to its customers within the AD&S sector.

The company has established facilities for MRO of its own products and with foreign partners to provide MRO services for their AD&S products in India. Sika continues to work on prestigious Indian projects in the AD&S sector, building on its established expertise in systems integration, documentation, and certification.

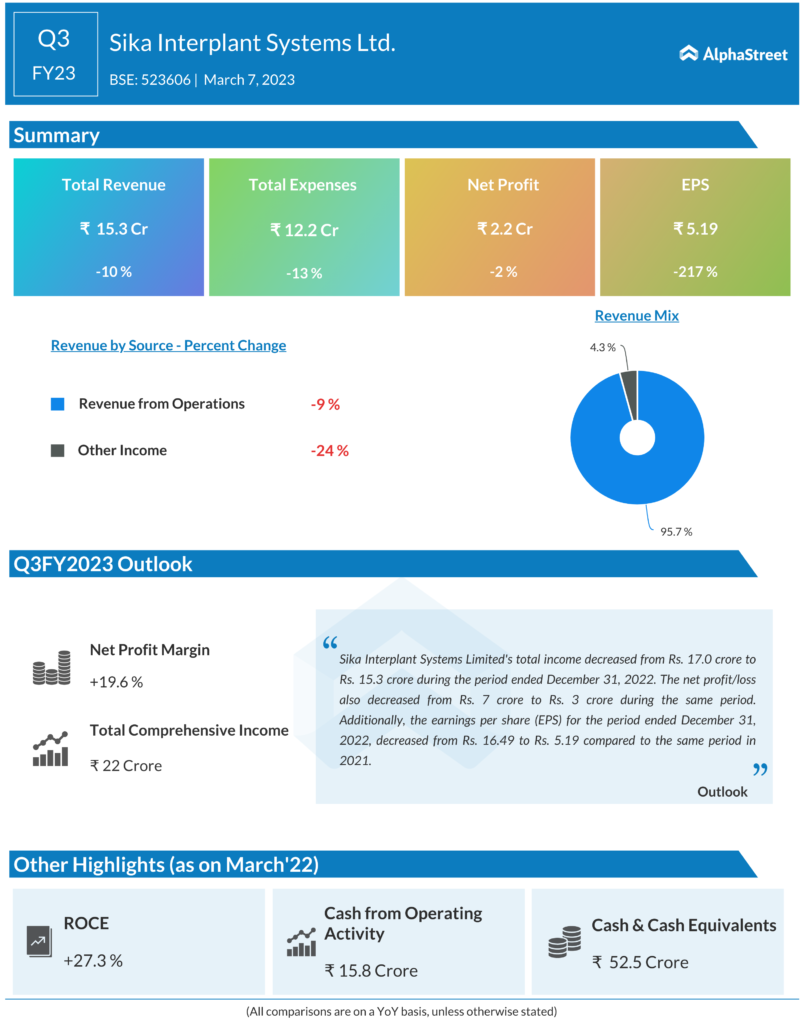

During the period ended December 31, 2022, the company reported a total income of Rs. 15.3 crore, which is a significant decrease from the Rs. 28.0 crore reported during the period ended September 30, 2022. Similarly, the net profit for the December 31, 2022 period was Rs. 2.2 crore, which is lower than the net profit of Rs. 5.0 crore reported for the September 30, 2022 period. The EPS also decreased from Rs. 11.95 for the September 30, 2022 period to Rs. 5.19 for the December 31, 2022 period.