APL Apollo Tubes Limited, a leading branded manufacturer of steel products in India, reported exceptional financial results for Q2 FY26, overcoming a challenging market environment.

Financial Highlights:

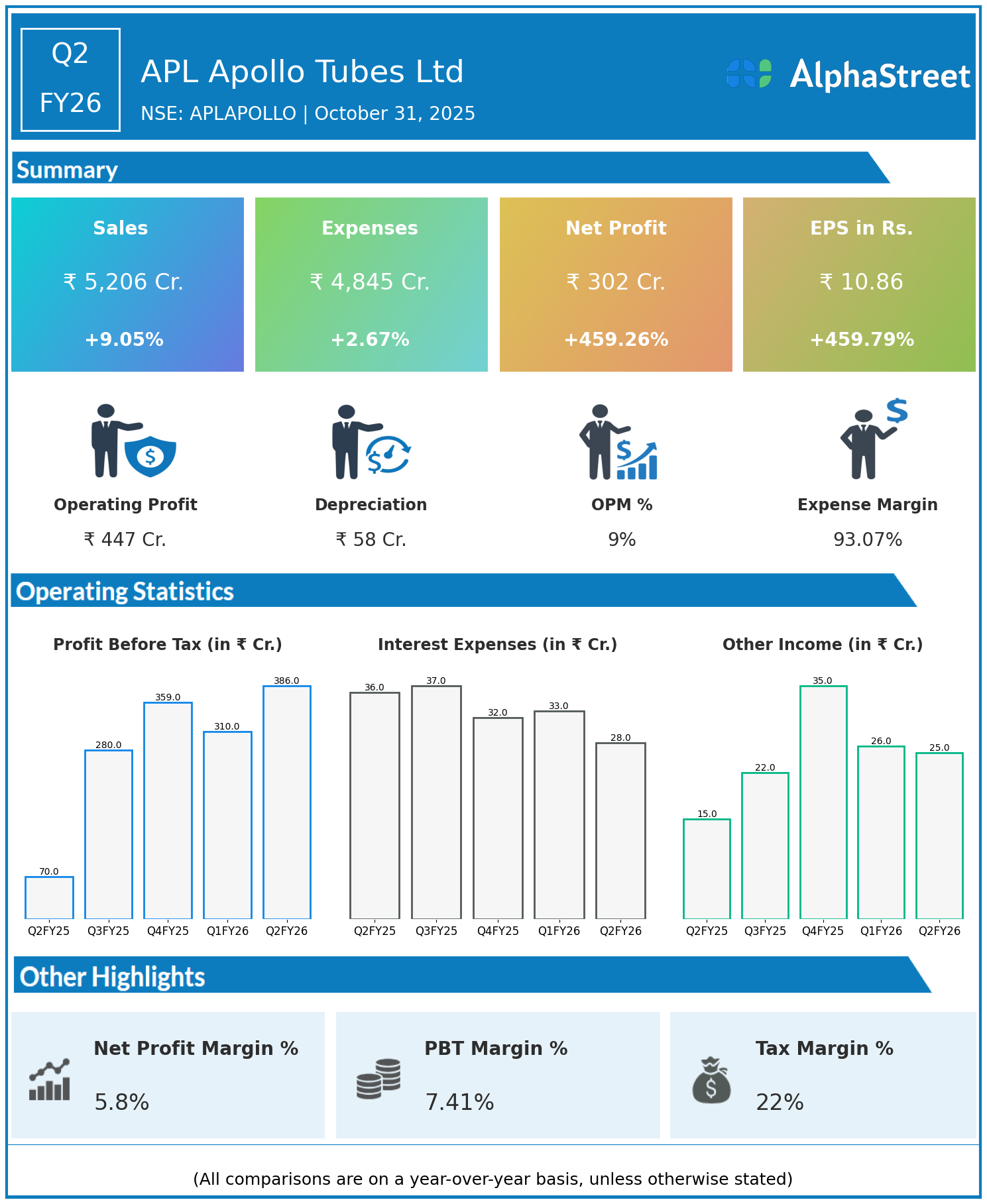

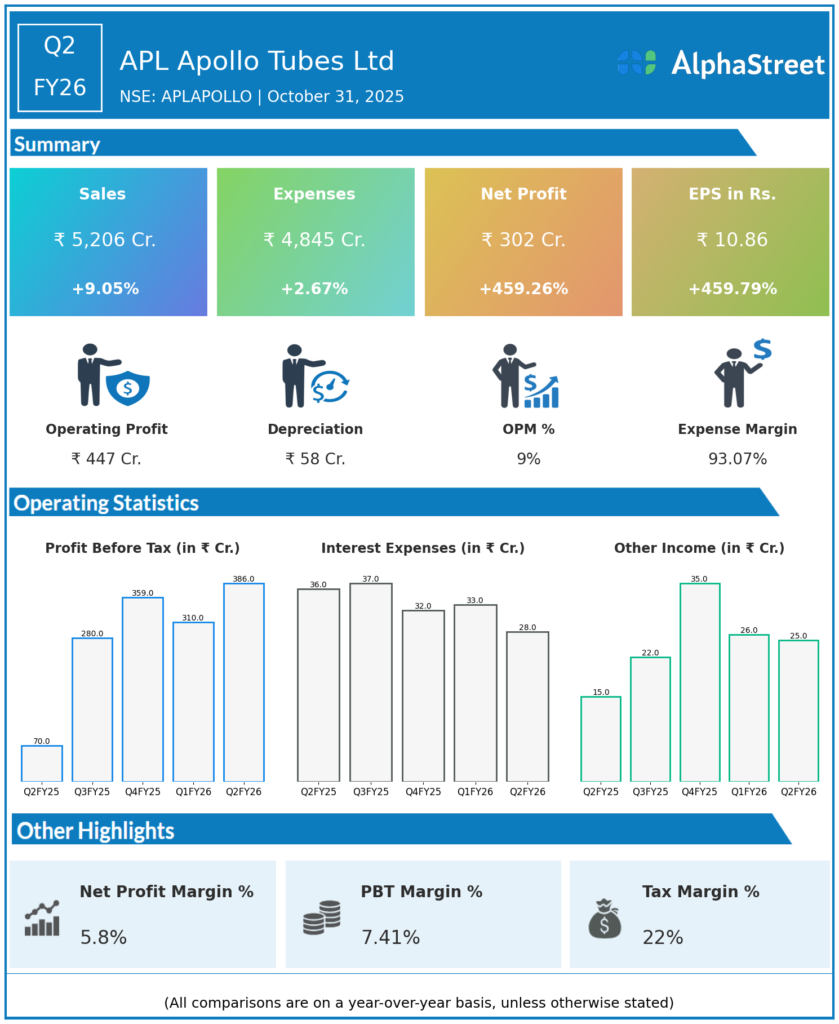

- Revenue rose 9.05% year on year to ₹5,206 crore from ₹4,774 crore.

- Total expenses increased moderately by 2.67% to ₹4,845 crore from ₹4,719 crore.

- Consolidated net profit skyrocketed 459.26% to ₹302 crore from ₹54 crore in Q2 FY25.

- Earnings per share (EPS) jumped 459.79% to ₹10.86 from ₹1.94.

Operational Performance:

- Sales volume increased 13% year on year to 855,037 tons, marking a record high.

- EBITDA surged 224% year on year to ₹447 crore, with EBITDA per ton rising 187% to ₹5,228.

- The company improved its value-added product mix to 57% of sales.

- Despite headwinds like extended monsoons and a subdued macroeconomic environment, APL Apollo demonstrated resilience through operational efficiency and strong brand presence.

- Net cash position remained robust at ₹512 crore.

Outlook:

APL Apollo’s management expressed confidence in achieving 10-15% volume growth in FY26 and maintaining strong EBITDA per ton, supported by product quality enhancements, customer satisfaction, and prudent working capital management.

This record quarter establishes APL Apollo Tubes as a robust player capable of delivering strong growth and profitability despite market challenges.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.