Tata Power Company Ltd is primarily involved in the business of the generation, transmission and distribution of electricity. It aims to produce electricity completely through renewable sources. It also manufactures solar roofs and plans to build 1 lakh EV charging stations by 2025 The company is India’s largest vertically-integrated power company.

Financial Results:

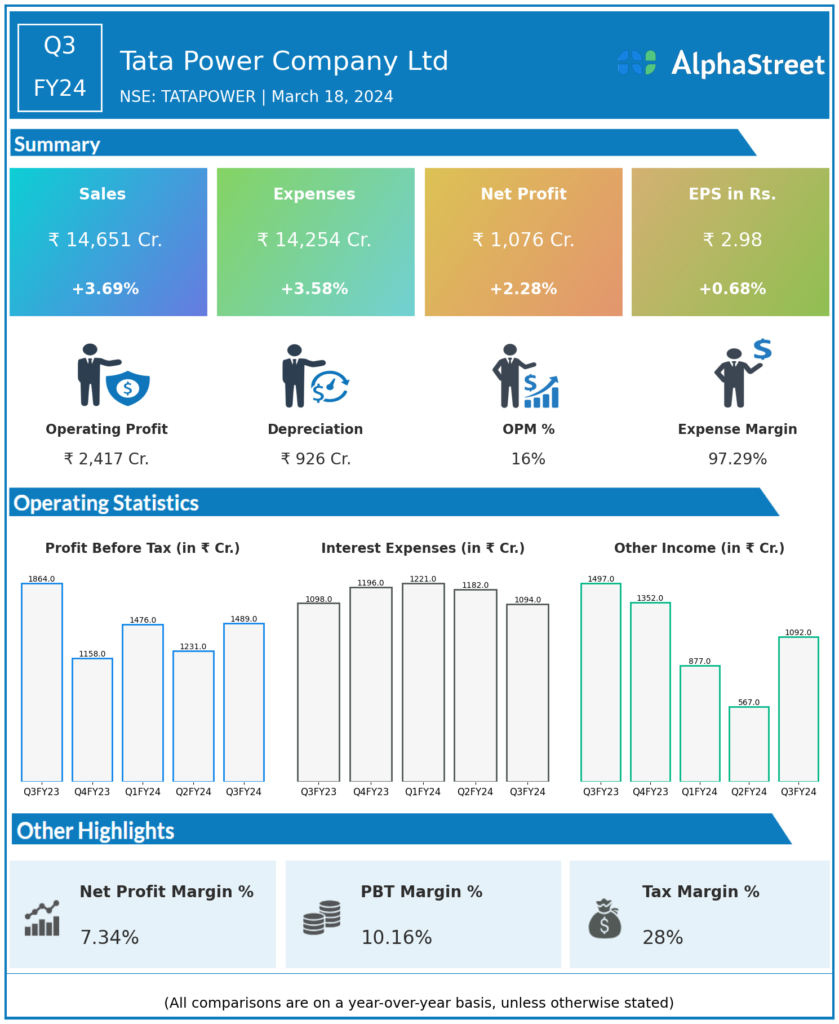

Tata Power Company Ltd reported Revenues for Q3FY24 of ₹14,651.00 Crores up from ₹14,129.00 Crore year on year, a rise of 3.69%.

Total Expenses for Q3FY24 of ₹14,254.00 Crores up from ₹13,761.00 Crores year on year, a rise of 3.58%.

Consolidated Net Profit of ₹1,076.00 Crores up 2.28% from ₹1,052.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹2.98, up 0.68% from ₹2.96 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.