Paisalo Digital Ltd was incorporated in 1992. It is a Non-Deposit Taking Non-Banking Financial Company registered office of the company is in Delhi and the head office is in Agra. The company provides a number of financial products like Business Loans, SME & MSME Loans, Income Generation Loans for business/self–employment purposes.

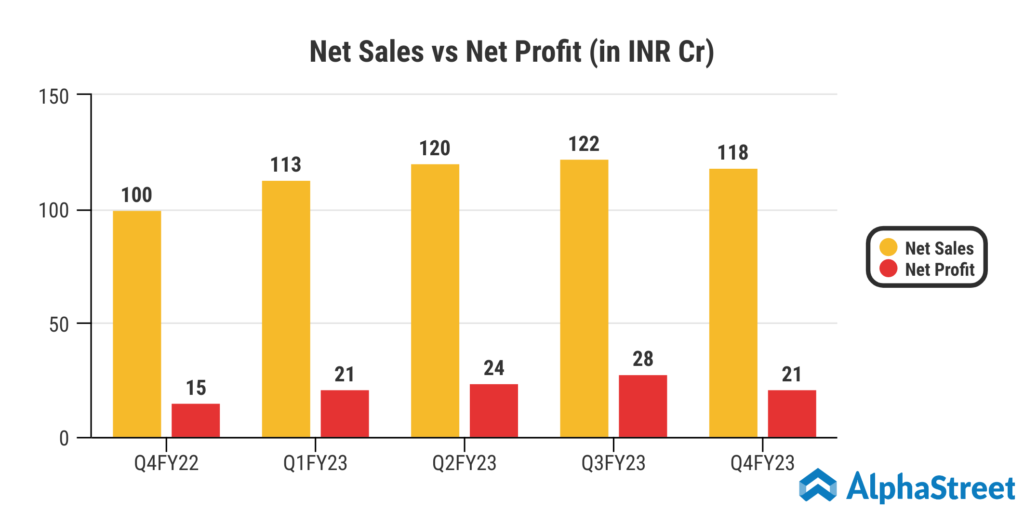

- Paisalo Digital Ltd reported Total revenue for Q4 FY23 of ₹118 Crore, up from ₹100 Crore year on year depicting a growth of 18%.

- Total Expenses for Q4 FY23 of ₹25 Crore down, from ₹28 Crore year on year, a decline of 11%.

- Consolidated Net Profit of ₹21 Crore, up 40% from ₹15 Crore in the same quarter of the previous year.

- The Earnings per Share is ₹0.46, down 35% from ₹0.34 in the same quarter of the previous year.