Krishna Medical Institution Ltd (KIMS) was Incorporated in the year 1973 and is one of the largest corporate healthcare groups in Andhra Pradesh and Telangana in terms of patients treated and treatments offered. The company offers multidisciplinary healthcare services with primary, secondary, and tertiary care across 2-3 tier cities and an additional quaternary healthcare facility in tier-1 cities.

Financial Results:

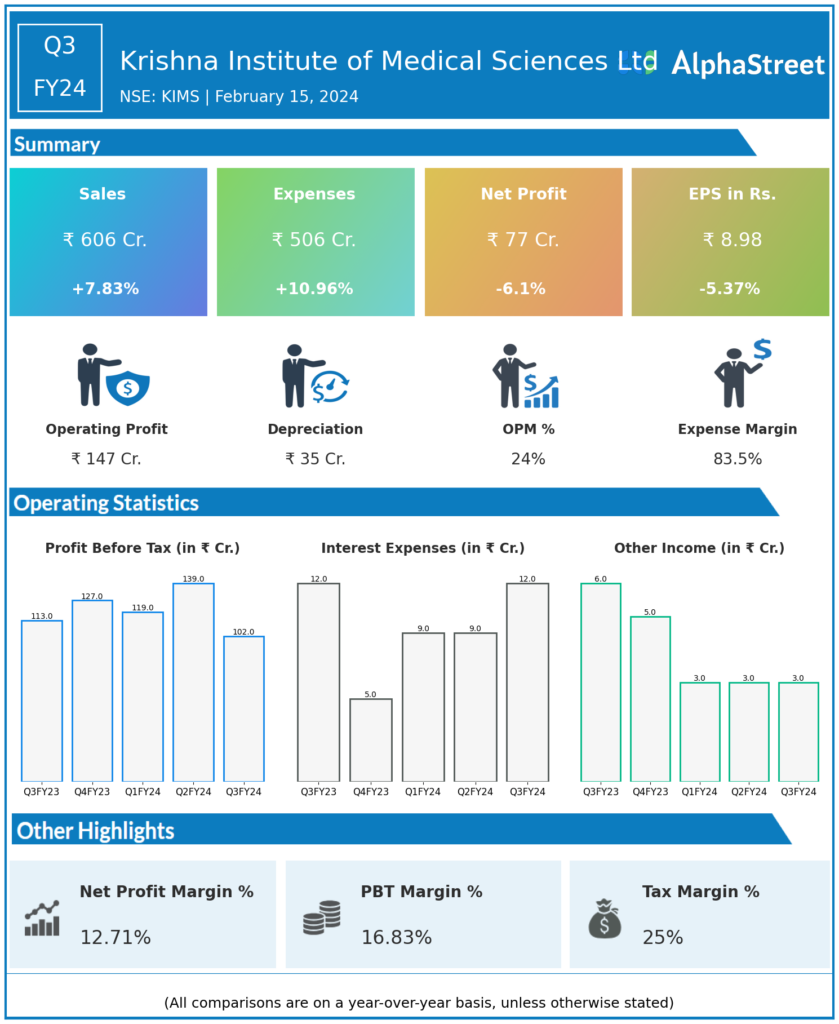

Krishna Institute of Medical Sciences Ltd reported Revenues for Q3FY24 of ₹606.00 Crores up from ₹562.00 Crore year on year, a rise of 7.83%.

Total Expenses for Q3FY24 of ₹506.00 Crores up from ₹456.00 Crores year on year, a rise of 10.96%.

Consolidated Net Profit of ₹77.00 Crores down 6.1% from ₹82.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹8.98, down 5.37% from ₹9.49 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.