Poonawalla Fincorp Limited (erstwhile Magma Fincorp Limited) is a non-deposit taking NBFC registered with RBI. It is engaged in providing consumer and MSME financing, as well as General Insurance services.

Financial Results:

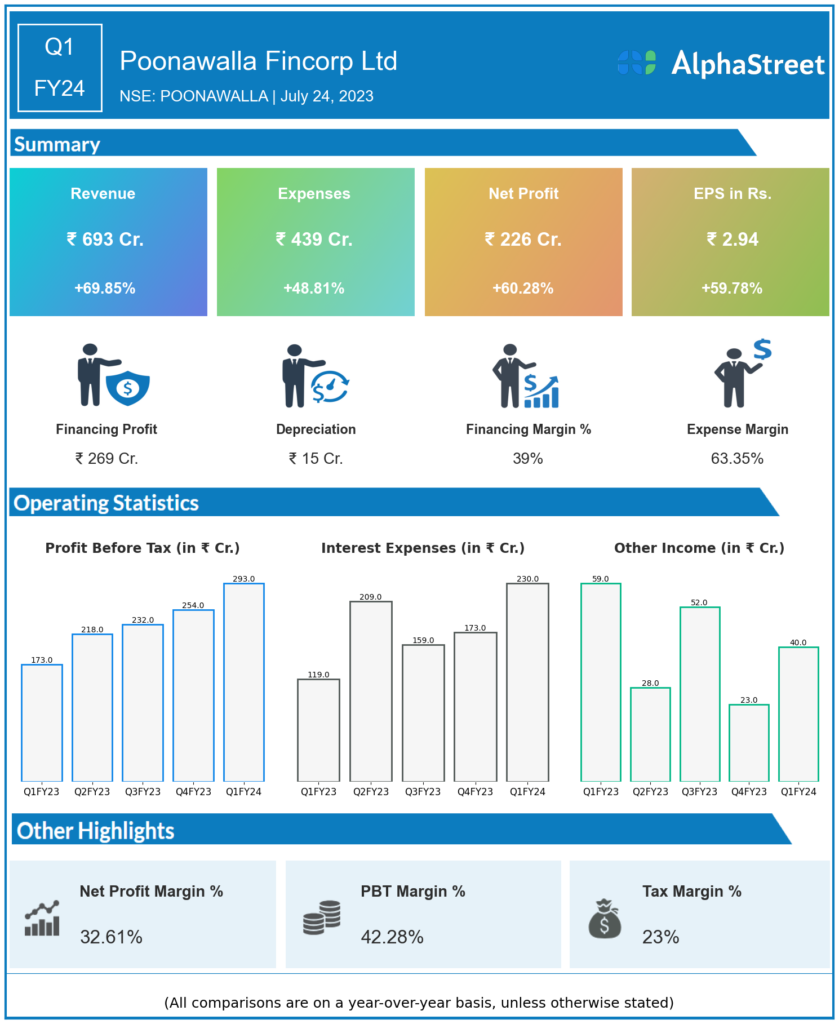

Poonawalla Fincorp Ltd reported Revenues for Q1FY24 of ₹693.00 Crores up from ₹408.00 Crore year on year, a rise of 69.85%.

Total Expenses for Q1FY24 of ₹439.00 Crores up from ₹295.00 Crores year on year, a rise of 48.81%.

Consolidated Net Profit of ₹226.00 Crores up 60.28% from ₹141.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹2.94, up 59.78% from ₹1.84 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.