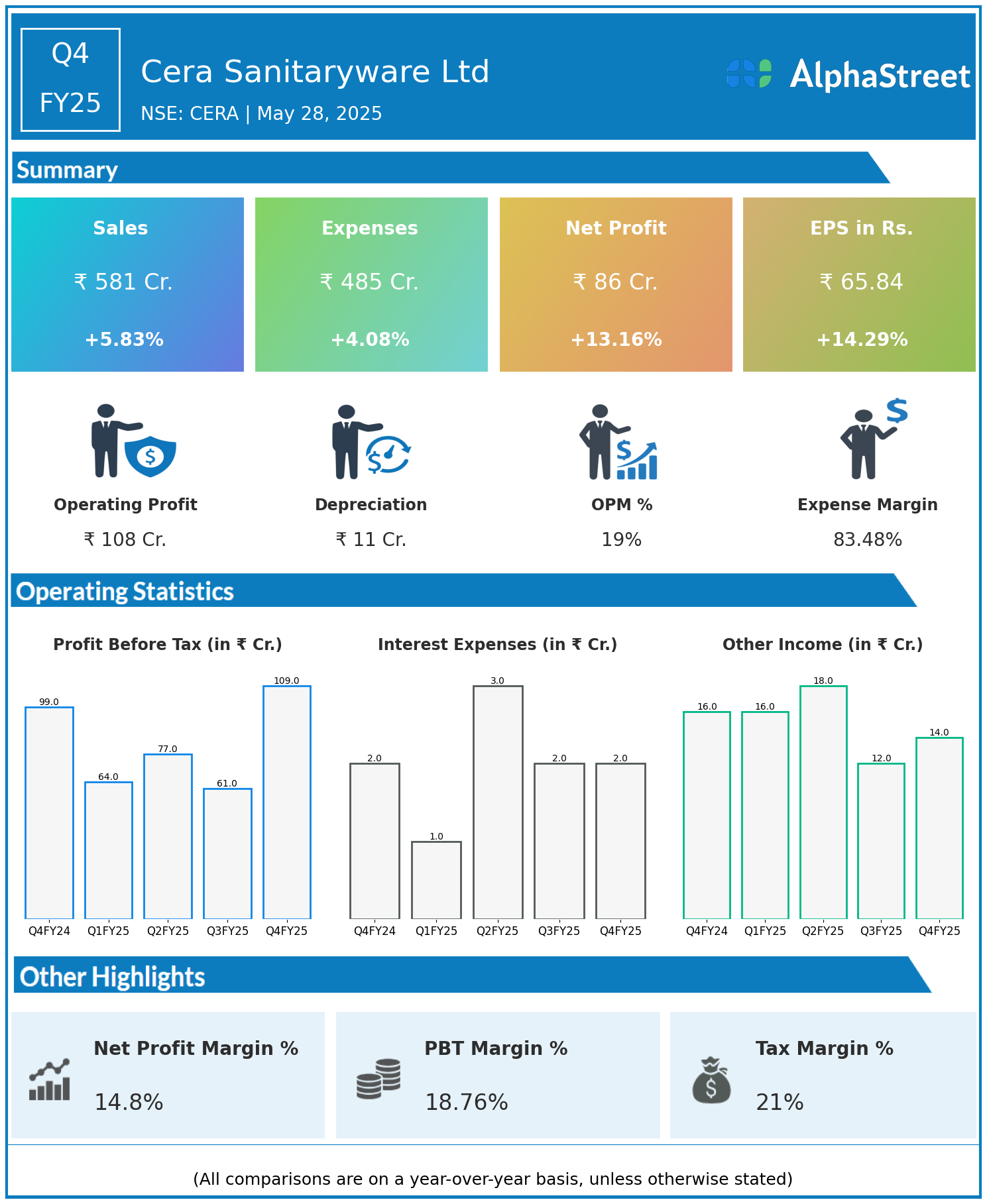

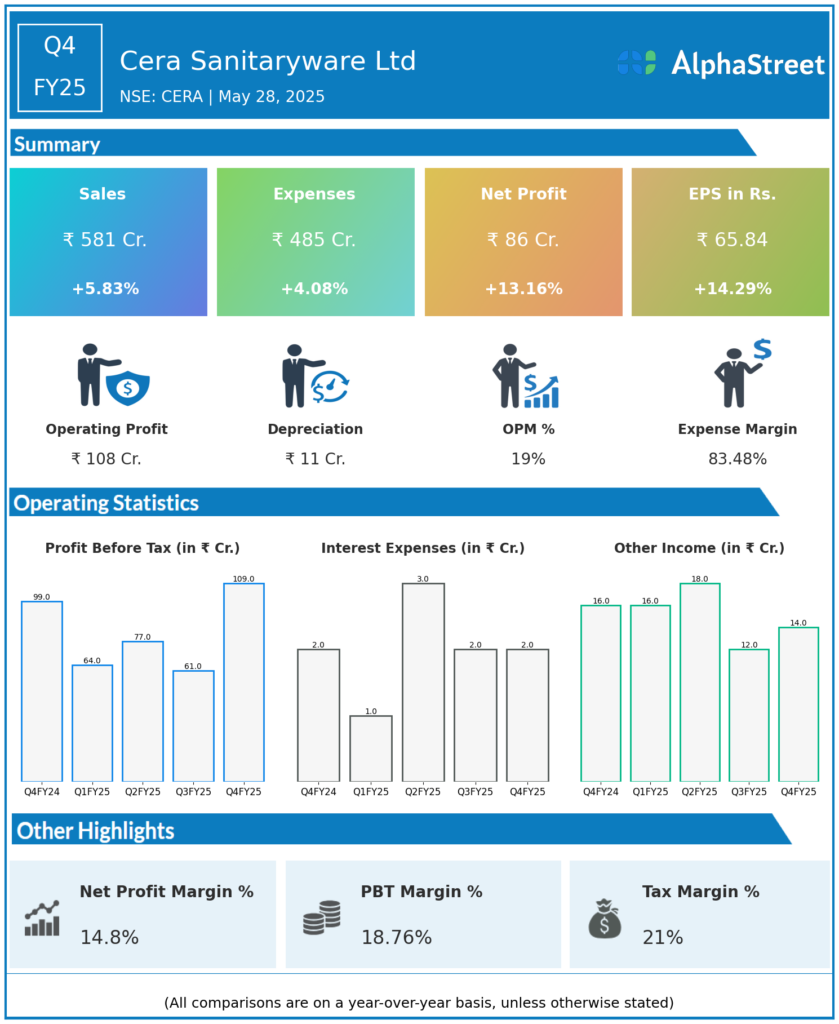

Cera Sanitaryware Ltd is engaged in the business of manufacturing, selling and trading of various kinds of building products. It also has non-conventional wind & solar power for captive use in the state of Gujarat.

Financial Results:

Cera Sanitaryware Ltd reported Revenues for Q4FY25 of ₹581.00 Crores up from ₹549.00 Crore year on year, a rise of 5.83%.

Total Expenses for Q4FY25 of ₹485.00 Crores up from ₹466.00 Crores year on year, a rise of 4.08%.

Consolidated Net Profit of ₹86.00 Crores up 13.16% from ₹76.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹65.84, up 14.29% from ₹57.61 in the same quarter of the previous year.