Go Digit General Insurance Ltd, incorporated in 2016, offers motor, health, and other general insurance products through a digital-first approach.

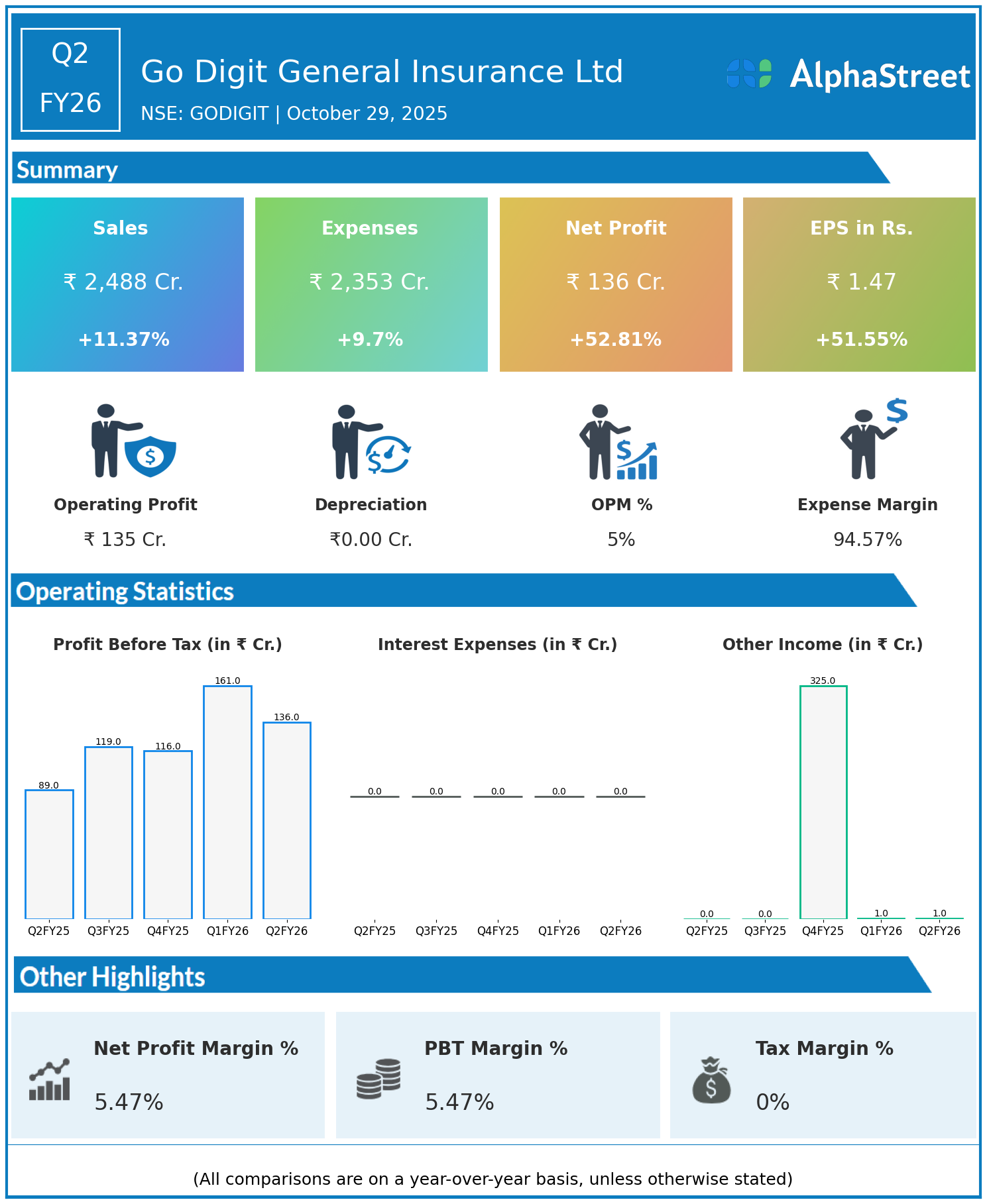

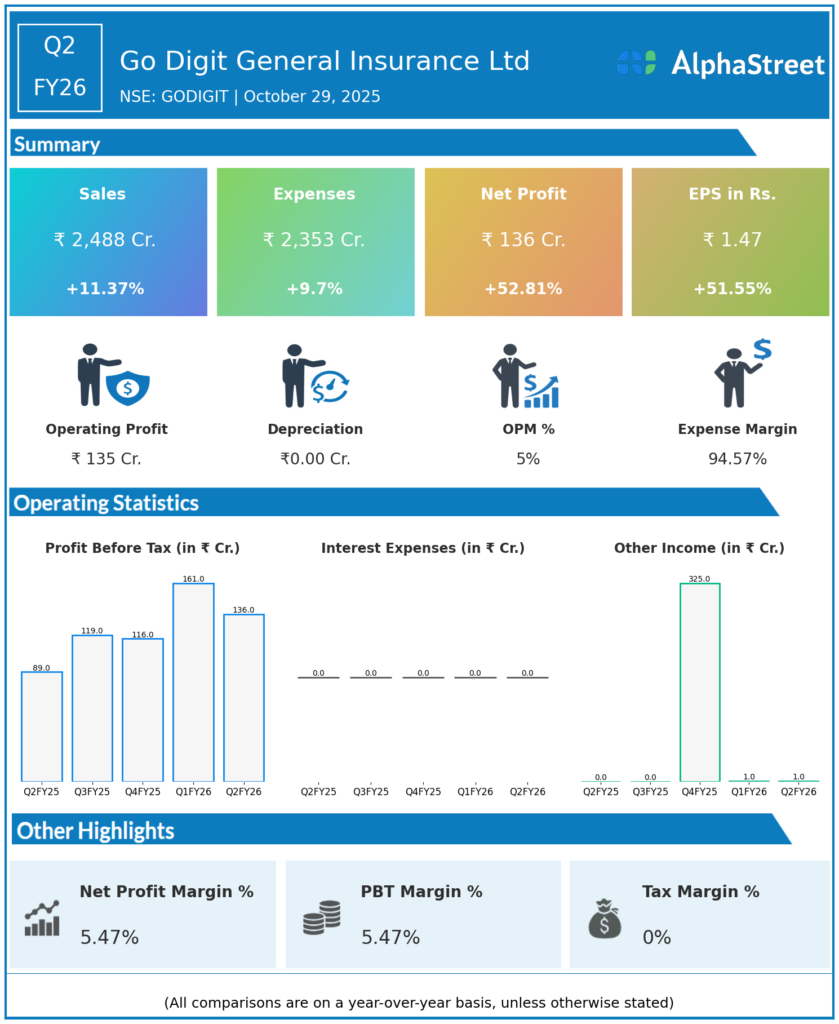

Financial Summary:

- Revenues rose 11.37% year on year to ₹2,488 crore from ₹2,234 crore.

- Total expenses increased 9.7% to ₹2,353 crore from ₹2,145 crore.

- Consolidated net profit surged 52.81% to ₹136 crore from ₹89 crore.

- Earnings per share (EPS) improved 51.55% to ₹1.47 from ₹0.97.

Key Highlights:

- Gross written premium (GWP) grew 12.6% to ₹2,667 crore, supported by broad-based growth across motor, health, and fire insurance segments.

- Combined ratio improved to 111.4% from 112.2%, reflecting enhanced underwriting profitability and expense management.

- Loss ratio increased slightly to 73% from 70.6%, balanced by a decline in expense ratio to 38.4% from 41.6%, owing to efficiency improvements in distribution and technology.

- Investment income rose driven by higher assets under management (AUM), which grew 15.4% year on year to ₹21,345 crore.

- The company maintains a healthy solvency ratio of 2.26x, surpassing regulatory norms.

Outlook:

Lean operations, technology adoption, and diversified product portfolio position Go Digit for sustained profitable growth in India’s competitive insurance market.

Go Digit’s Q2FY26 robust profit rise underscores its operational efficiency and scalable business model driving strong growth.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.