IIncorporated in 1995, Bharti Hexacom Ltd provides consumer mobile services, fixed-

line telephone and broadband services in Rajasthan and Northeast telecom circles

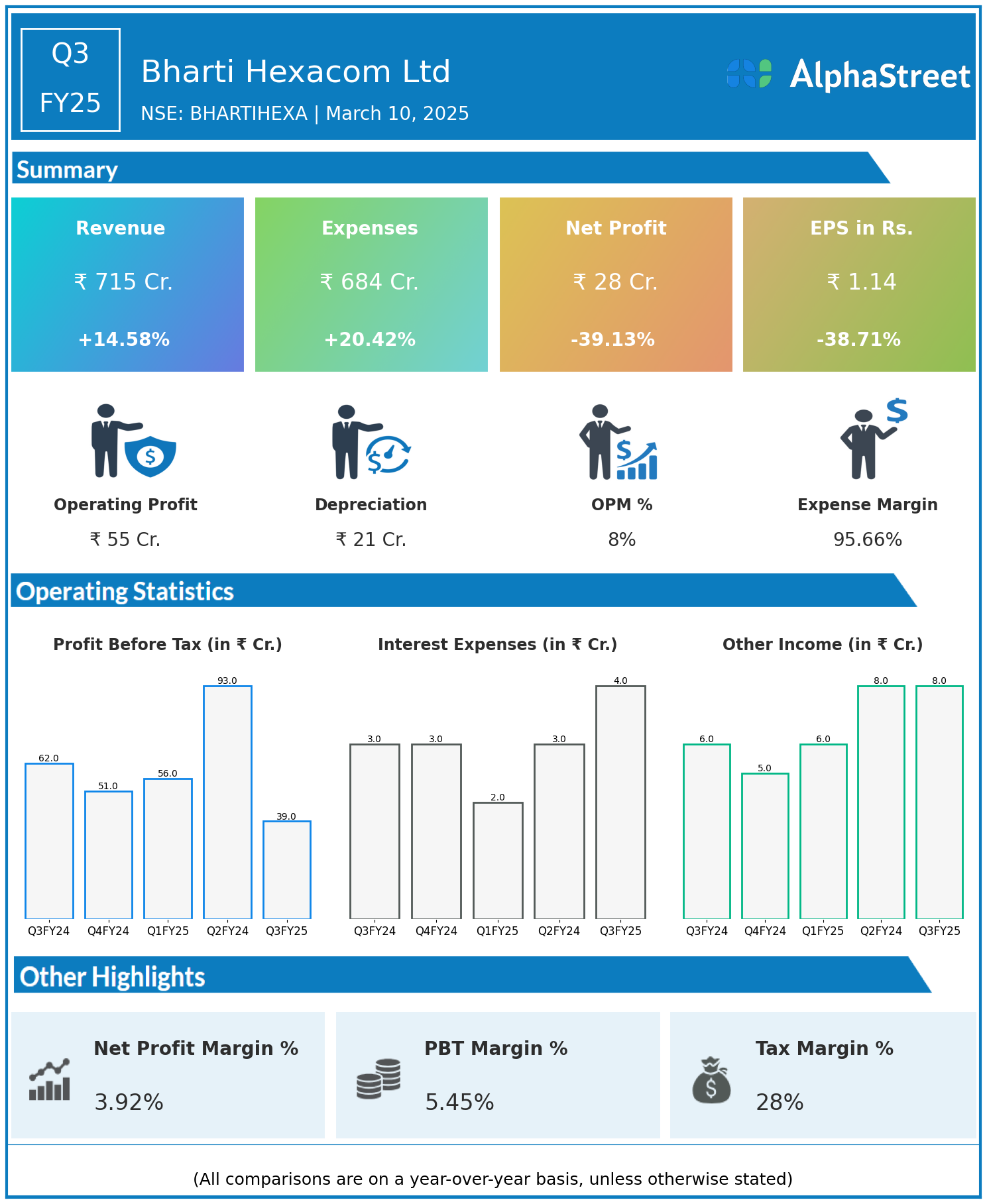

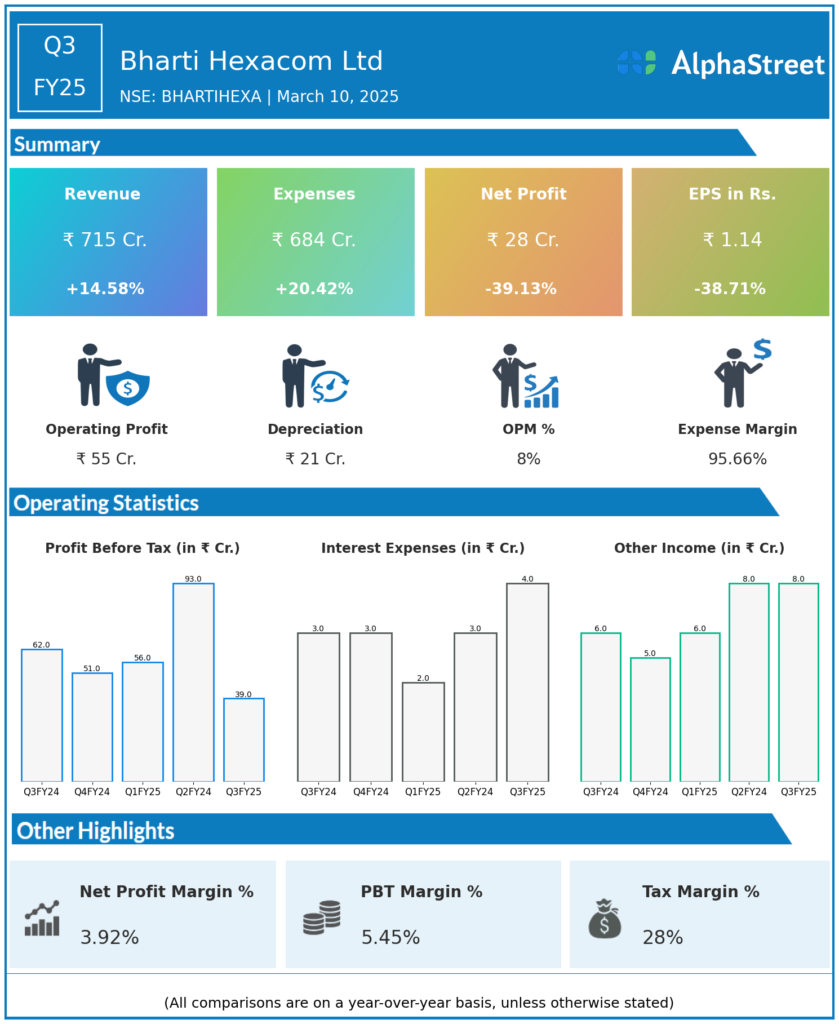

Financial Results:

Bharti Hexacom Ltd reported Revenues for Q3FY25 of ₹715.00 Crores up from ₹624.00 Crore year on year, a rise of 14.58%.

Total Expenses for Q3FY25 of ₹684.00 Crores up from ₹568.00 Crores year on year, a rise of 20.42%.

Consolidated Net Profit of ₹28.00 Crores down 39.13% from ₹46.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹1.14, down 38.71% from ₹1.86 in the same quarter of the previous year.