Siemens Limited offers products, integrated solutions for industrial applications for manufacturing industries, drives for process industries, intelligent infrastructure and buildings, efficient and clean power generation from fossil fuels and oil & gas applications, transmission and distribution of electrical energy for passenger and freight transportation, including rail vehicles, rail automation and rail electrification systems.

Financial Results:

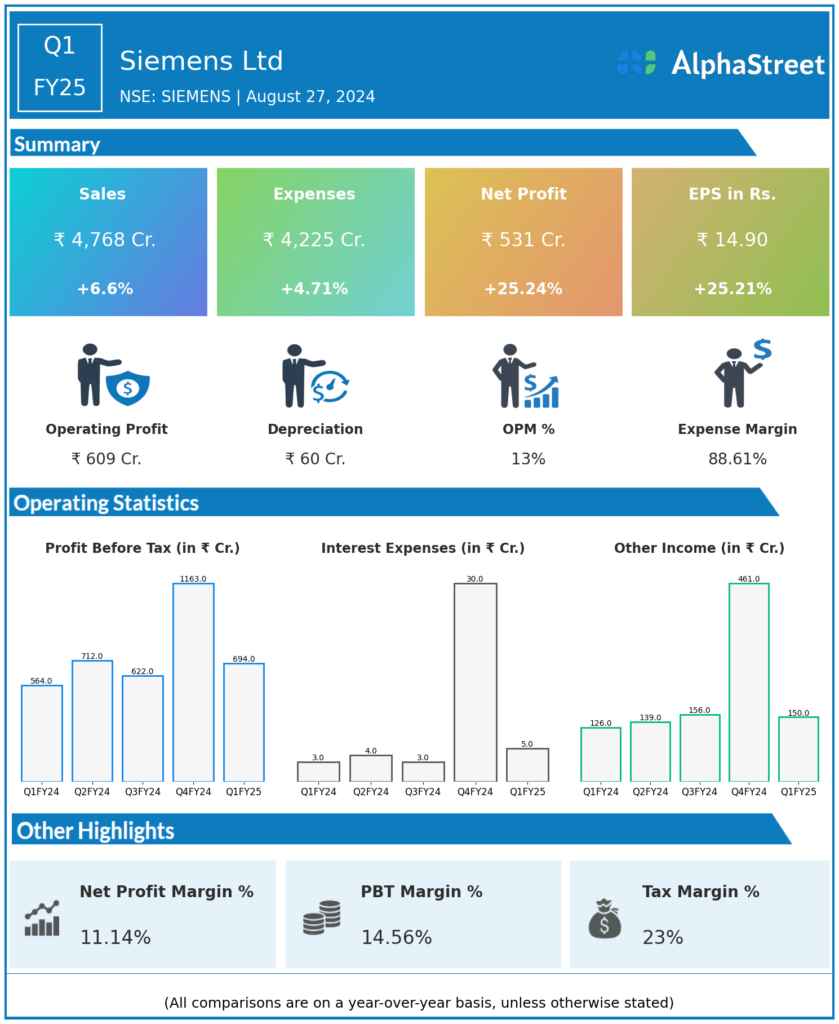

Siemens Ltd reported Revenues for Q1FY25 of ₹4,768.00 Crores up from ₹4,473.00 Crore year on year, a rise of 6.6%.

Total Expenses for Q1FY25 of ₹4,225.00 Crores up from ₹4,035.00 Crores year on year, a rise of 4.71%.

Consolidated Net Profit of ₹531.00 Crores up 25.24% from ₹424.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹14.90, up 25.21% from ₹11.90 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.