NXTDIGITAL Limited (formerly known as Hinduja Ventures Limited), a part of the Hinduja Group is engaged in the distribution of TV signals both through Cable and Satellite and also provides broadband services through its subsidiary ONEOTT entertainment Limited (OIL).

Financial Result:

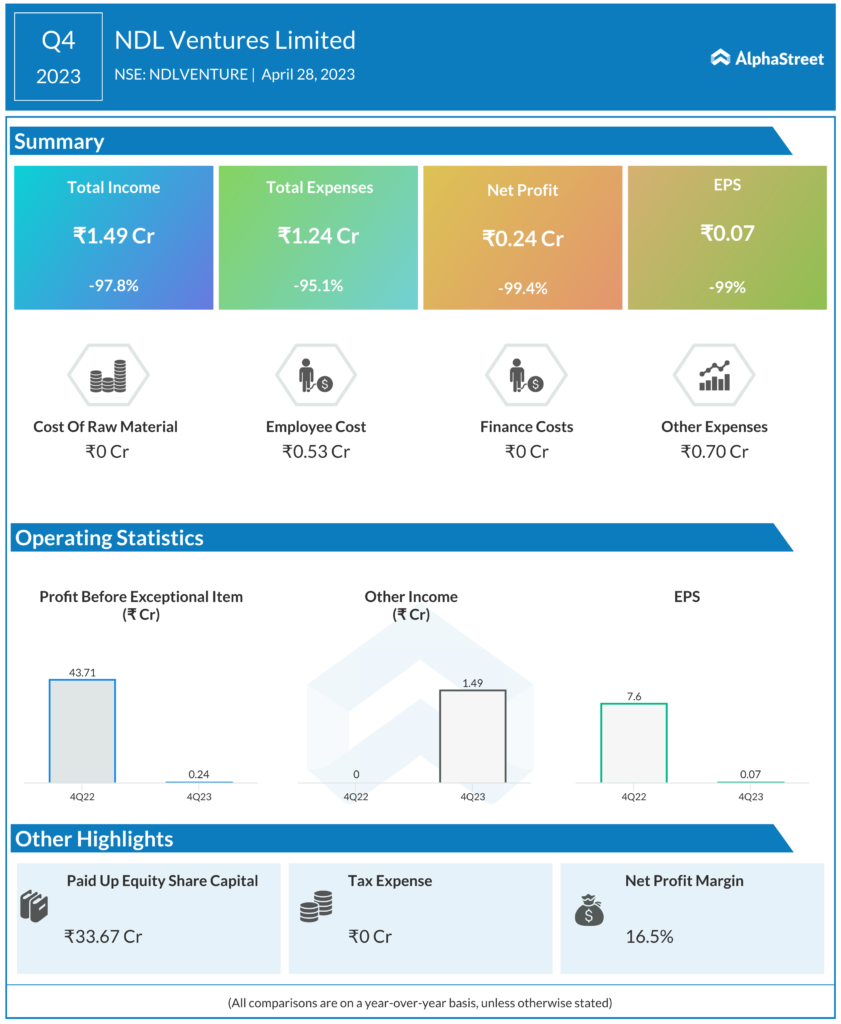

- NDL Ventures Ltd reported Revenues for Q4FY23 of ₹1.49 Crore, down by 97.8% year on year.

- Total Expenses for Q4FY23 of ₹1.24 Crores down from ₹25.58 Crores year on year, a decrease of 95.1%.

- Consolidated Net Profit of ₹0.24 Crores down 99.4% from ₹21.81 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹0.07, down 99% from ₹7.6 in the same quarter of the previous year.