Voltas is engaged in the business of air conditioning, refrigeration, electro – mechanical projects as an EPC contractor both in domestic and international geographies (Middle East and Singapore) and engineering product services for mining, water management and treatment, construction equipments and textile industry.

Financial Results:

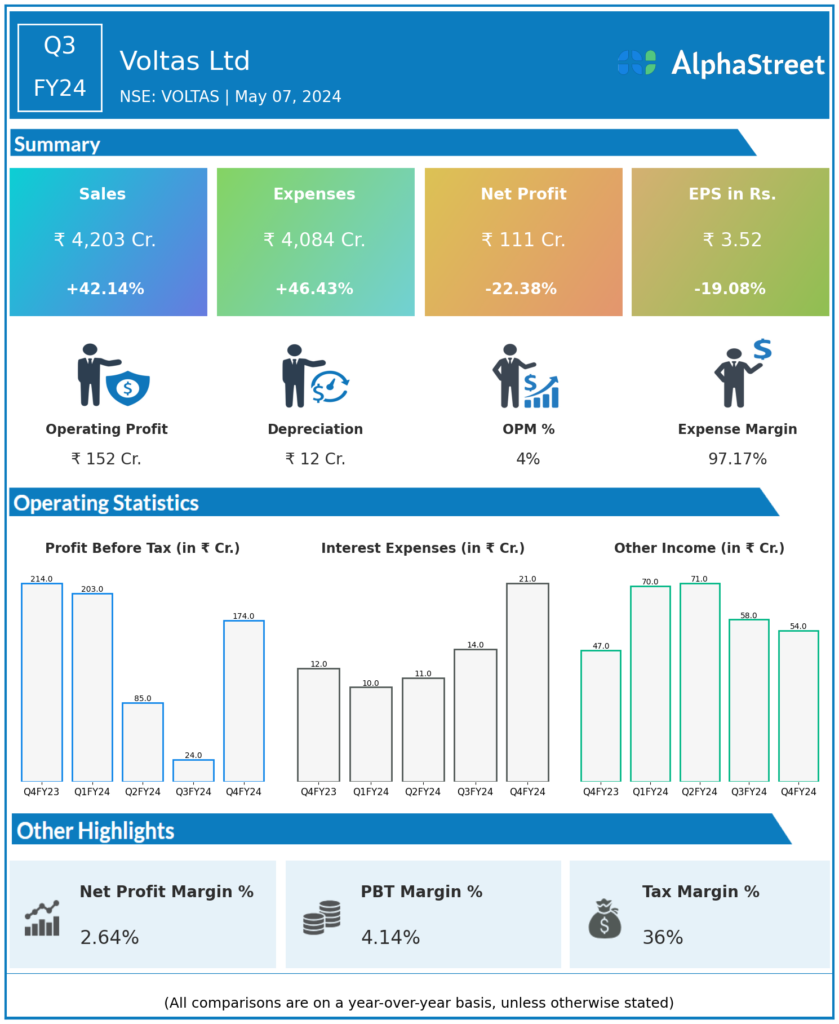

Voltas Ltd reported Revenues for Q4FY24 of ₹4,203.00 Crores up from ₹2,957.00 Crore year on year, a rise of 42.14%.

Total Expenses for Q4FY24 of ₹4,084.00 Crores up from ₹2,789.00 Crores year on year, a rise of 46.43%.

Consolidated Net Profit of ₹111.00 Crores down 22.38% from ₹143.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹3.52, down 19.08% from ₹4.35 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.