ITI Limited, engaged in manufacturing, trading and servicing of telecommunication equipment and related services, reported a sharp decline in topline performance in Q2FY26. The company primarily focuses on offering telephone communication services.

Financial performance

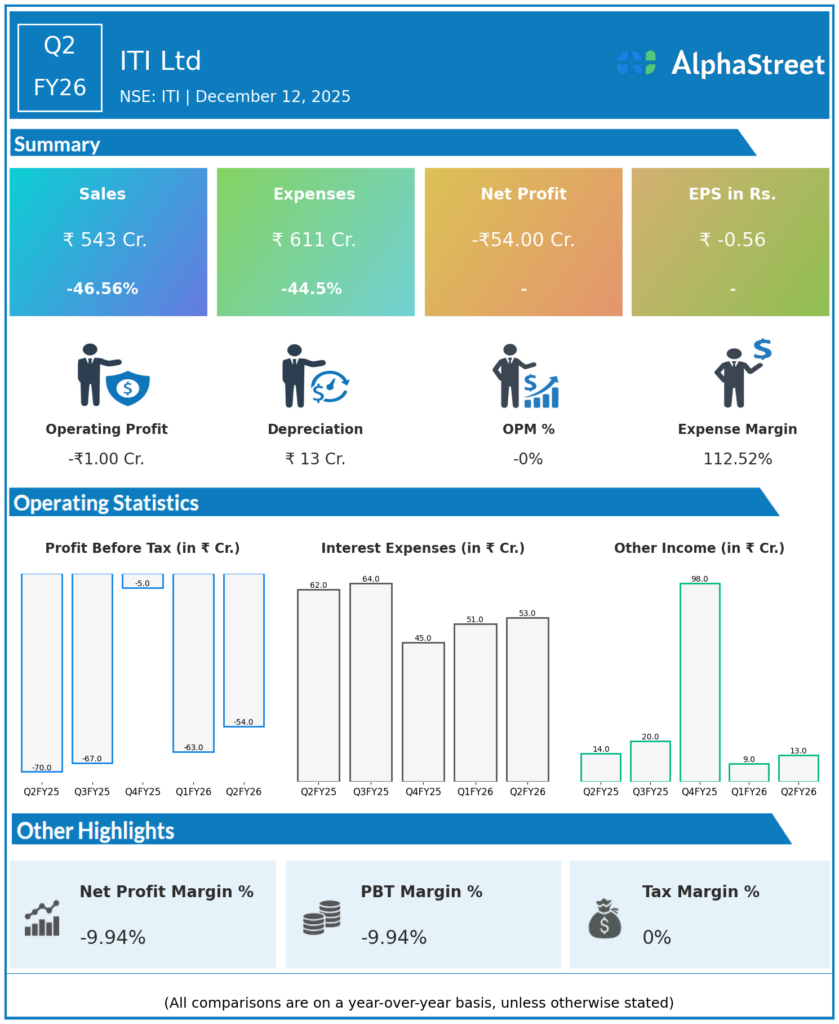

- Revenues for Q2FY26 stood at ₹543 crore, down from ₹1,016 crore year-on-year, a decline of 46.56%.

- Total expenses fell to ₹611 crore from ₹1,101 crore, a reduction of 44.5%.

- Consolidated net loss improved to ₹54 crore from a loss of ₹70 crore in the same quarter of the previous year.

- Earnings per share came in at -₹0.56 versus -₹0.73 in the corresponding quarter last year.

Key takeaways

The steep drop in revenue indicates a materially weaker business volume or execution during the quarter, though cost rationalisation helped limit losses. The narrowing net loss and improved EPS, despite the revenue decline, suggest some operational efficiencies but also highlight the need for a more sustainable revival in order inflows and project execution.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.