Titan Company Ltd is among India’s most respected lifestyle companies. It has established leadership positions in the Watches, Jewellery and Eyewear categories led by its trusted brands and differentiated customer experience. It was founded in 1984 as a joint-venture between TATA Group and Tamilnadu Industrial Development Corporation (TIDCO).

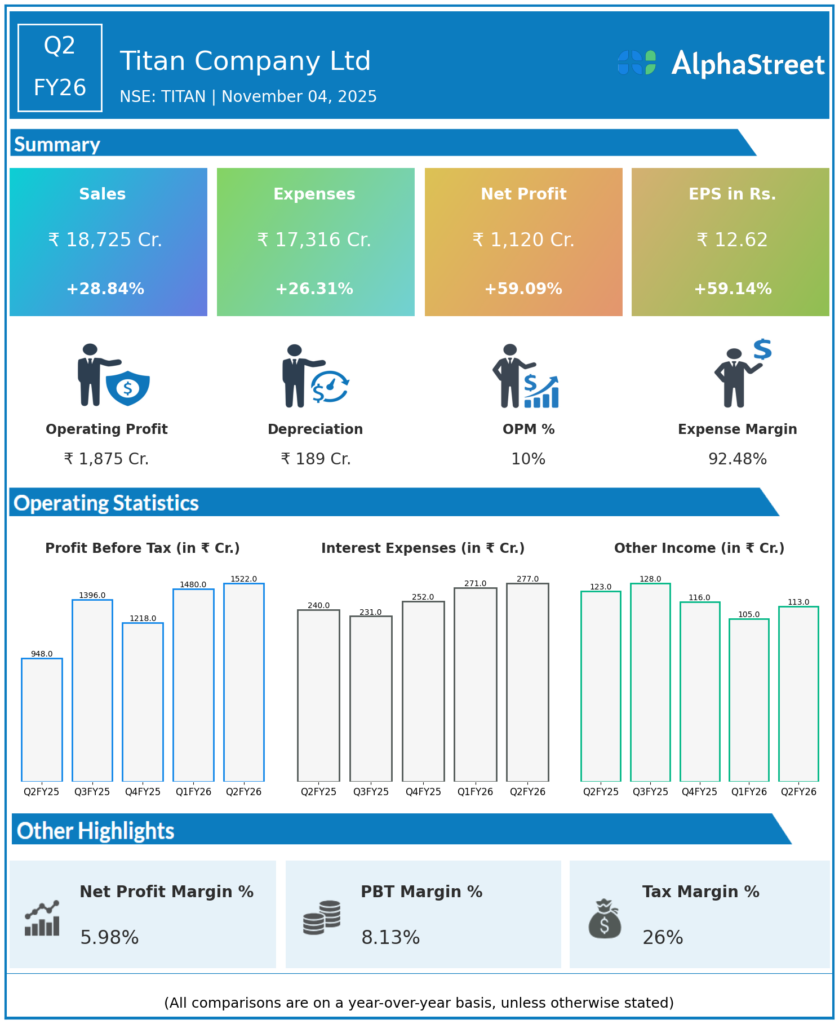

Q2 FY26 Earnings Results:

-

Consolidated Total Income: ₹18,725 crore, up 28.84% YoY from ₹14,656 crore in Q2 FY25.

-

Net Profit After Tax (PAT): ₹1,120 crore, up 59.1% YoY from ₹704 crore.

-

EBITDA: ₹1,987 crore, rose 46.3% YoY from ₹1,358 crore.

-

EBITDA Margin: Expanded by 209 basis points YoY to 12.1%.

-

PAT Margin: Improved 163 basis points YoY to 6.8%.

-

Jewellery division (excluding bullion and DigiGold) grew 21% YoY to ₹14,092 crore.

-

Domestic jewellery brands (Tanishq, Mia, Zoya) grew 18% YoY; CaratLane grew 32% YoY to ₹1,072 crore.

-

International jewellery revenue nearly doubled to ₹561 crore led by UAE and North America markets.

-

Watches and wearables segment revenue up 13% YoY to ₹1,477 crore; EBIT margin was strong at 16.1%.

-

Eyecare segment revenue increased 9% YoY to ₹220 crore with EBIT at ₹12 crore (margin 5.3%).

-

New product launches, premiumization, and festive season strongly drove performance.

-

Operating profit margin at 11.39%, up 222 basis points YoY but down 96 basis points QoQ.

-

Sequential margin dip attributed to seasonality and product mix.

-

Employee costs rose to ₹616 crore YoY, manageable against revenue growth.

-

Interest cost increased to ₹277 crore YoY, linked to higher working capital due to inventory build-up.

-

Effective tax rate at 26.41%.

Management Commentary and Strategic Insights:

-

Managing Director C.K. Venkataraman highlighted strong festive demand, early Navratri momentum, and consumer affinity for Titan’s brands as growth drivers.

-

The jewellery business’s resilience despite elevated gold prices demonstrated robust market position.

-

The company is focusing on customer satisfaction, expanding retail network, and launching innovative product offerings.

-

Margins up year-on-year but facing typical seasonal challenges in Q2.

-

Working capital elevated due to inventory supporting aggressive growth plans; cash flow management will be key.

-

Titan announced plans to acquire controlling stake in Damas Jewellery to expand international footprint.

Q1 FY26 Earnings Results:

-

Consolidated Revenue: ₹16,523 crore.

-

PAT: ₹1,091 crore, up around 52.5% YoY.

-

EBITDA: ₹1,830 crore.

-

Jewellery revenue strong with 18.6% growth YoY.

-

Watch and eyecare segments also saw robust growth.

-

Operating margin at 12.35%, slightly higher than Q2.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.