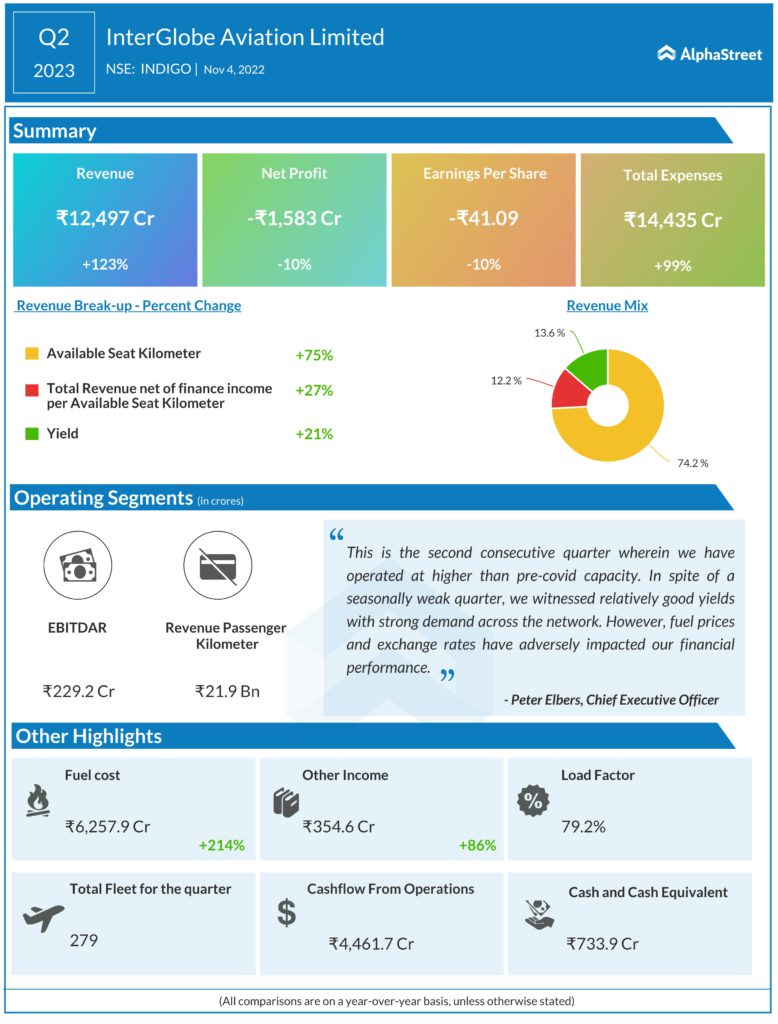

InterGlobe Aviation Limited (NSE: INDIGO) reported Q2FY23 Revenue, which increased to ₹12,497.58 Crores from ₹5,608.49 Crores, growth rate of 123% year on year. However, the Net Profit declined by 10% down to -₹1,583.33 Crores from -₹1,435.65 Crores year over year. The Earnings per share is -₹41.09 for this quarter.