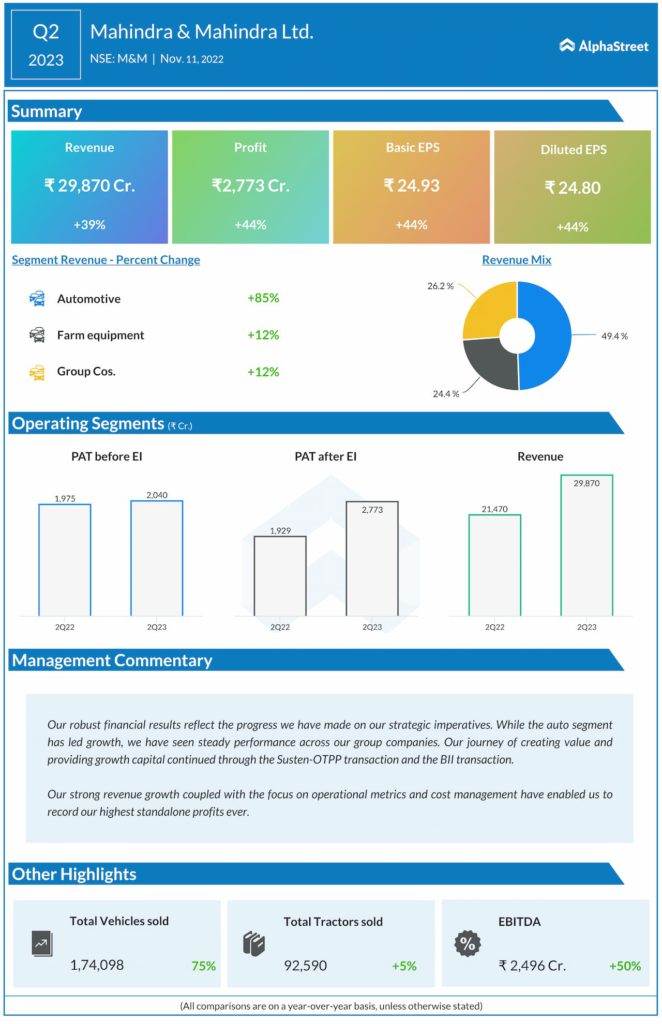

Mahindra And Mahindra Ltd‘s revenue in Q2FY23 rose 39% to ₹ 29,870 crores. Consolidated Profit came at ₹ 2,773 crores showcasing a 44% rise YoY over the corresponding period.

In this quarter’s press release, the reports suggested that the firm has observed a rise in profits with a significant 75% YoY increase in total vehicle sold.