The Indian Hotels Company Ltd is primarily engaged in the business of owning, operating & managing hotels, palaces and resorts.

Financial Results:

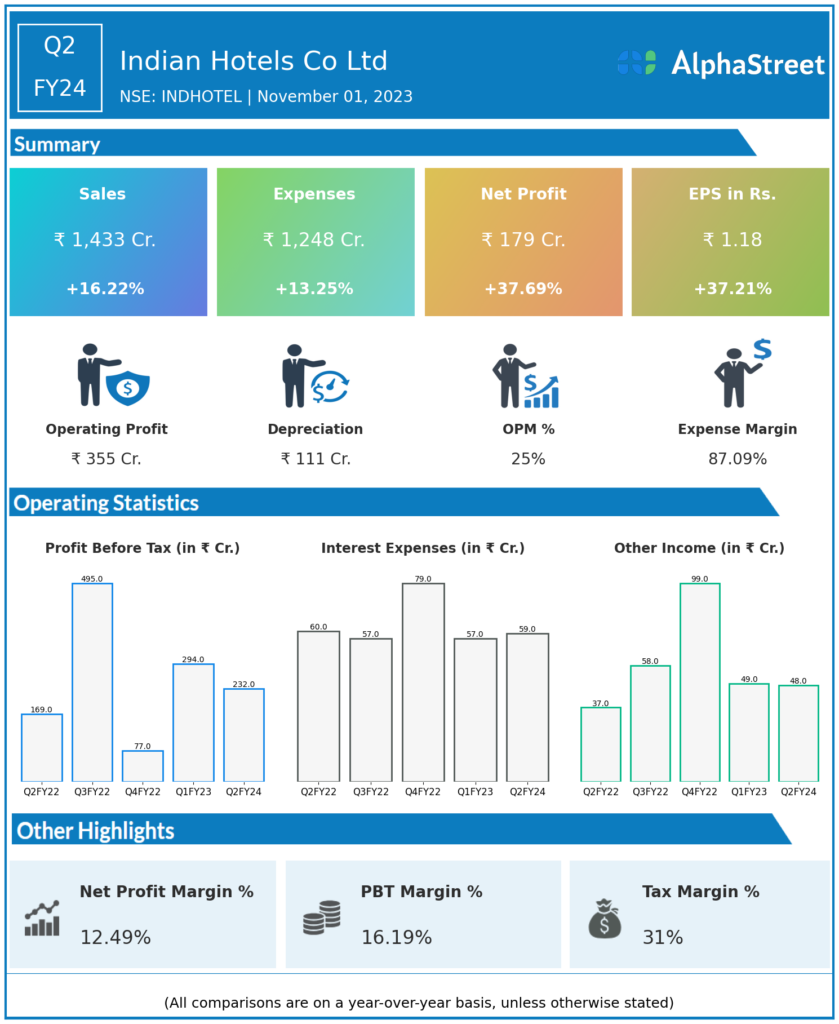

- Indian Hotels Co Ltd reported Revenues for Q2FY24 of ₹1,433.00 Crores up from ₹1,233.00 Crore year on year, a rise of 16.22%.

- Total Expenses for Q2FY24 of ₹1,248.00 Crores up from ₹1,102.00 Crores year on year, a rise of 13.25%.

- Consolidated Net Profit of ₹179.00 Crores up 37.69% from ₹130.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹1.18, up 37.21% from ₹0.86 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.