Westlife Development Limited (WDL) focuses on establishing and operating McDonald’s restaurants across West and South India, through its wholly owned subsidiary Hardcastle Restaurants Pvt Ltd (HRPL). Today, It manages 319 McDonalds restaurants and 223 McCafé outlets in West and South India in easily accessible and popular locations like malls, high-streets, shopping complexes and residential areas’ after outlet presence. It employees close to 10,000 employees.

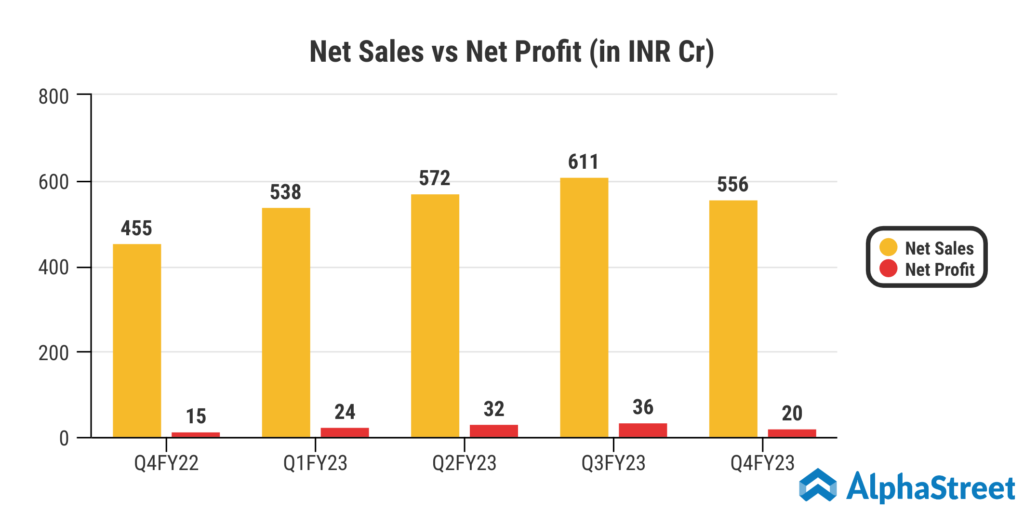

- Westlife Development Ltd reported Total revenue for Q4 FY23 of ₹556 Crore, up from ₹455 Crore year on year depicting a growth of 22%.

- Total Expenses for Q4 FY23 of ₹468 Crore up, from ₹392 Crore year on year, a growth of 19%.

- Consolidated Net Profit of ₹20 Crore, up 33% from ₹15 Crore in the same quarter of the previous year.

- The Earnings per Share is ₹1.29, up 32% from ₹0.98 in the same quarter of the previous year.