Innova Captab Limited (NSE: INNOVACAP) has emerged as a noteworthy player in India’s pharmaceutical landscape, combining contract development and manufacturing (CDMO) services with a branded generics business.

In recent quarters, the company has delivered strong top-line growth coupled with improving profitability, reflecting both operational execution and expanding market reach. In Q3 FY26, revenue surged approximately 42% year-on-year to ₹450.3 cr, while profit after tax (PAT) climbed about 23% to ₹42.1 cr, supported by robust revenue growth and diversified business streams. EBITDA also expanded by nearly 40% to ₹71.1 cr over Q3 FY25, albeit with a slight margin contraction.

Business Model: The Three Pillars

Innova divides its operations into three distinct revenue-generating segments.

- CDMO: This is the core engine. They manufacture over 600 generic products for approximately 182 customers, including 14 of the top 15 Indian pharma companies. Their value proposition is “one-stop-shop” manufacturing, from R&D to final packaging.

- Domestic Branded Generics: Innova develops and markets its own generic formulations under its own brand names within India. They utilize a massive distribution network of 5,000+ stockists and over 200,000 retail touchpoints.

- International Branded Generics: This segment focuses on exporting their branded products to emerging and semi-regulated markets (over 60 countries). They are currently pushing into more regulated territories like the UK and Canada following recent GMP approvals (UK-MHRA)

Market Situation: Indian Pharma & CDMO Environment

The Indian pharmaceutical industry remains a global powerhouse, often dubbed the “pharmacy of the world,” producing a large share of the world’s generic drugs and accounting for substantial exports, particularly to the U.S. and Europe.

Within CDMO, India’s competitive landscape includes companies that offer outsourced development, manufacturing and regulatory-compliant supply chain services to global pharma firms, a sector expected to grow robustly given demand for diversified supply sources beyond China.

Competitive Position: How Innova Captab Stacks Up

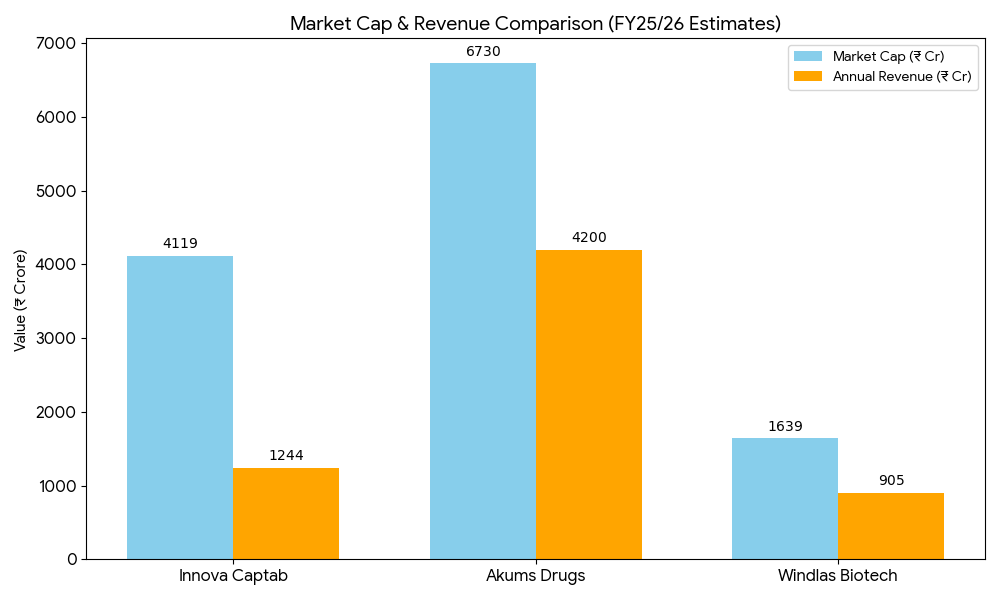

Innova Captab operates in a competitive mid-cap segment of the Indian pharmaceutical industry where peers range from large entrenched generics makers to specialized CDMO/ integrated players. Key competitors include both generic and CDMO-oriented firms. In the Indian pharmaceutical landscape, Innova Captab competes directly with other specialized CDMO and generic formulation manufacturers.

- Akums Drugs & Pharmaceuticals: The dominant leader in the Indian CDMO space. Akums generally outperforms Innova Captab on scale, revenue, and historical return on equity (ROE).

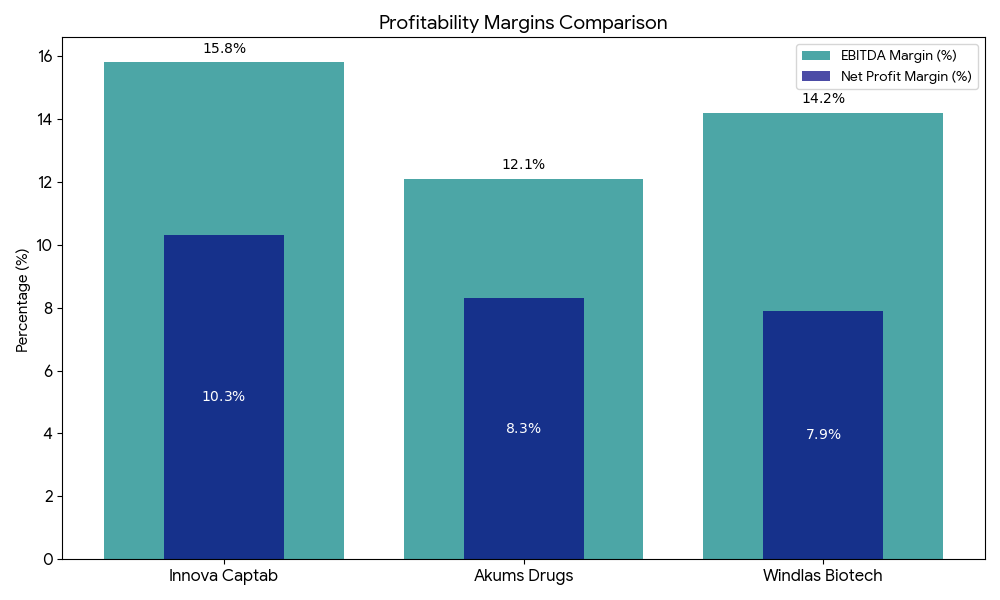

- Windlas Biotech: A smaller but highly efficient peer. Recent data suggests Windlas has shown better profit growth margins and technical momentum, though Innova Captab maintains a larger market cap and higher absolute revenue.

- Dishman Carbogen Amcis: Competes in the high-end CDMO space, though with a different focus on complex APIs and global clinical research.

- Vimta Labs: Competes in the analytical and contract research segment of the pharma value chain.

Key Competitive Takeaways

- Growth Leader: While Akums has the scale, Innova is currently the growth leader in terms of percentage increases, reporting a massive 42.3% YoY revenue jump in its latest Q3 FY26 results.

- Product Sticky-ness: By serving 14 of the top 15 Indian pharma companies, Innova has a “moat” of trust that makes it difficult for smaller players like Windlas to displace them from major contracts.

- Incentive Advantage: The Jammu facility provides Innova with unique fiscal benefits, including a 6% interest subvention and GST-linked incentives, which will likely keep its margins superior to competitors in the near term.

Where Does Innova Captab Stand Today?

Innova Captab Limited is a fast-growing mid-tier pharmaceutical company with a diversified CDMO and branded generics model that supports earnings stability. Recent growth has been driven by capacity expansion and global regulatory approvals, improving its competitive positioning. Ongoing investments underpin medium-term growth, while margin pressures and competitive intensity remain key risks to monitor.