Real estate development is Macrotech Developers Ltd’s main line of work. It is one of the biggest developers of real estate in India, with operations in the Pune and MMR (Mumbai Metropolitan Region) markets. The firm has developed a number of brands over the years, including iThink, Lodha Excelus, Lodha Supremus, and Lodha Signet for its office spaces, in addition to Lodha, CASA, Crown, and Lodha, Lodha Luxury names for its premium and luxury home developments.

Financial Results:

- Mastek Limited reported Total Income for Q4FY23 of ₹ 3,271.71 Crores down from ₹ 3,481.92 Crore year on year, a fall of 6%.

- Total Expenses for Q4FY23 of ₹ 2,630.52 Crores down from ₹ 2,679.61 Crores year on year, a fall of 2%.

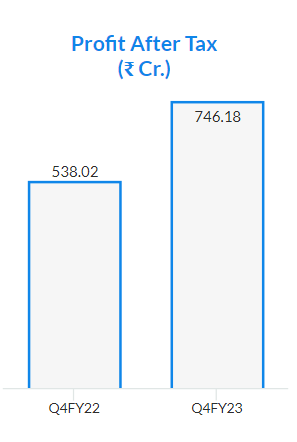

- Consolidated Net Profit of ₹ 746.18 Crores, up 39% from ₹ 538.02 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹ 15.43, up 39% from ₹ 11.10 in the same quarter of the previous year.