Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants. As of March 31, 2021, the company has a 333 million+ client base and 21 million+ registered merchants to whom it offers payment services, financial services, and commerce and cloud services.

Financial Results:

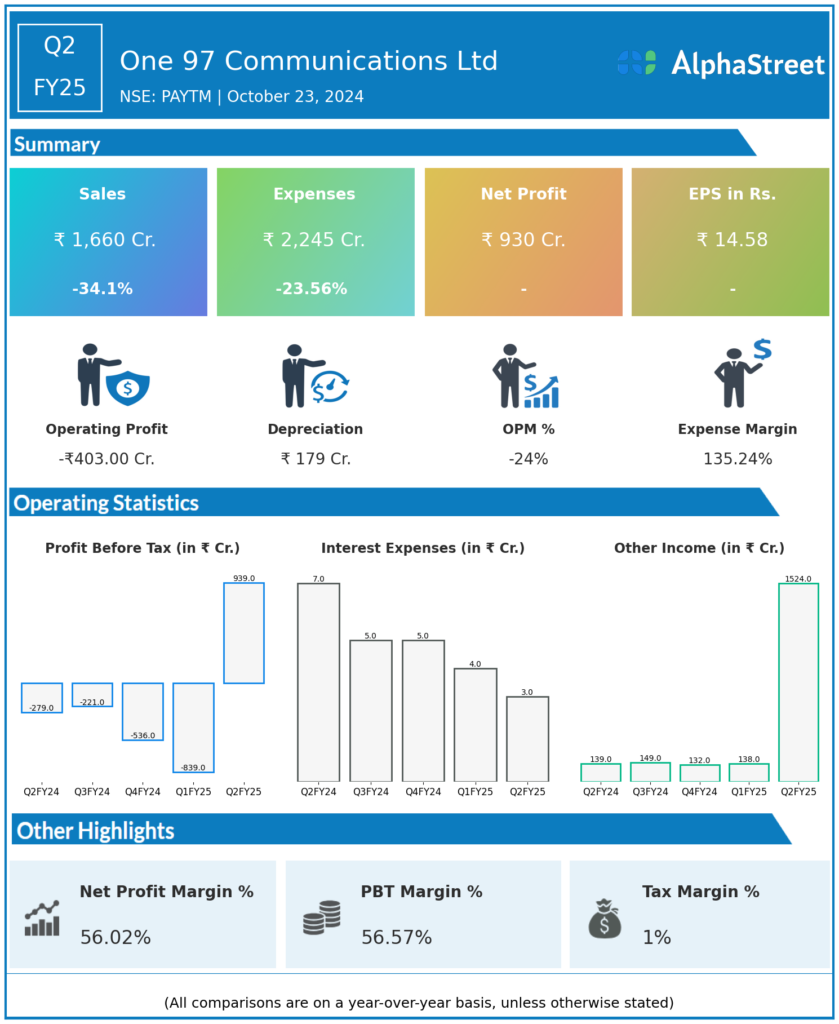

One 97 Communications Ltd reported Revenues for Q2FY25 of ₹1,660.00 Crores down from ₹2,519.00 Crore year on year, a fall of 34.1%.

Total Expenses for Q2FY25 of ₹2,245.00 Crores down from ₹2,937.00 Crores year on year, a fall of 23.56%.

Consolidated Net Profit of ₹930.00 Crores from -₹292.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹14.58, from -₹4.58 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.