3i Infotech is now a Global Information Technology Company. The company’s business activities are divided into two categories viz: IT Solutions and Transaction. With its head office in Mumbai, the company has a presence in more than 50 countries.

Financial Results:

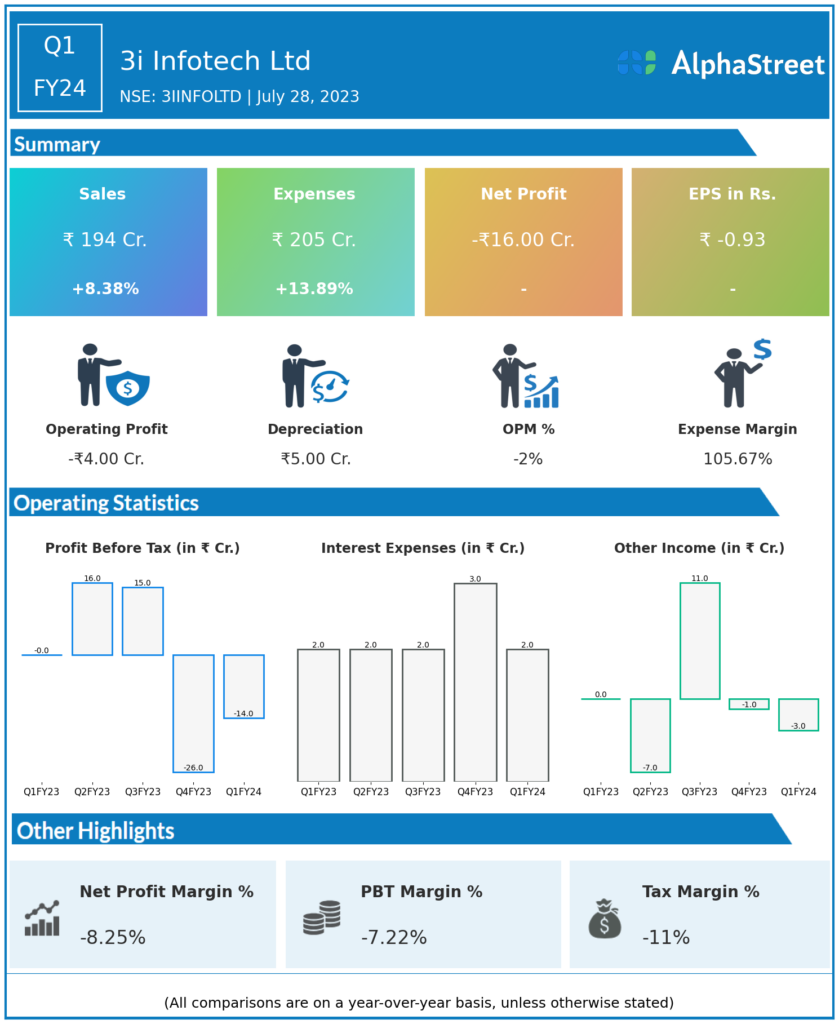

3i Infotech Ltd reported Revenues for Q1FY24 of ₹194.00 Crores up from ₹179.00 Crore year on year, a rise of 8.38%.

Total Expenses for Q1FY24 of ₹205.00 Crores up from ₹180.00 Crores year on year, a rise of 13.89%.

Consolidated Net Profit of -₹16.00 Crores from -₹2.00 Crores in the same quarter of the previous year.

The Earnings per Share is -₹0.93, from -₹0.09 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.