Jubilant FoodWorks Limited (JFL/Company) is part of the Jubilant Bhartia Group and is one of the India’s largest food service Company. The Company holds the master franchise rights for two international brands, Domino’s Pizza and Dunkin’ Donuts addressing two different food market segments and now has Popeyes in its food segment. The Company also launched its first homegrown brand – Hong’s Kitchen in Chinese cuisine segment.

Financial Results:

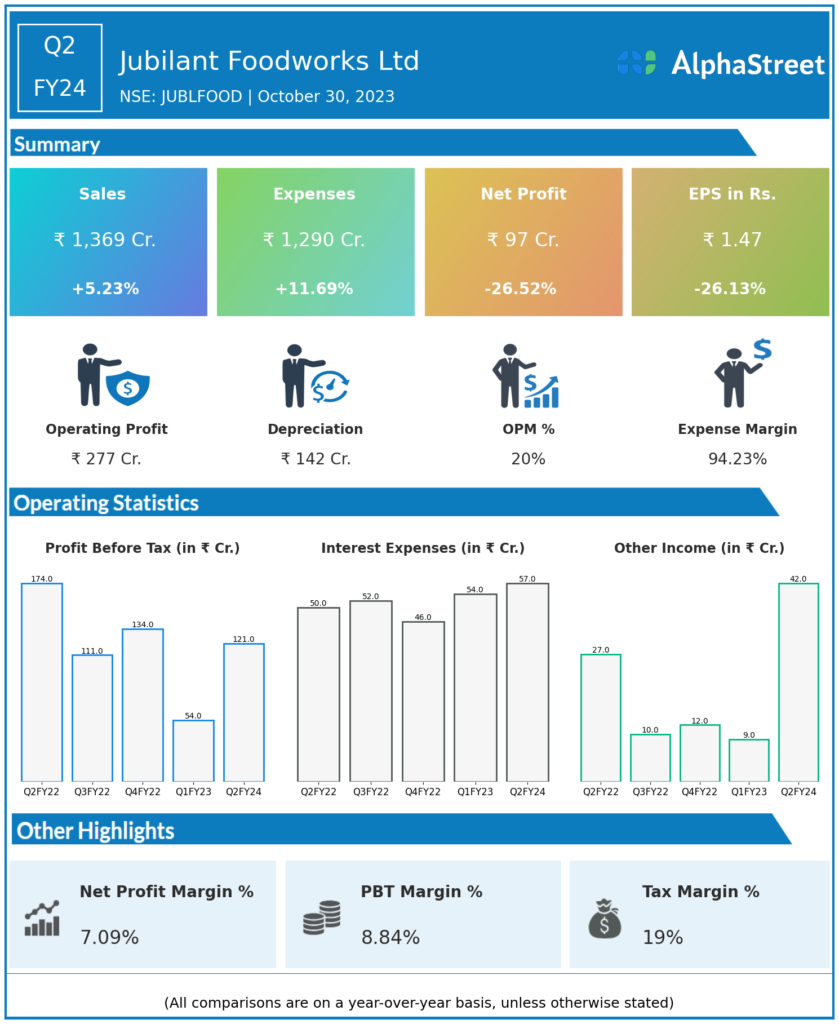

- Jubilant Foodworks Ltd reported Revenues for Q2FY24 of ₹1,369.00 Crores up from ₹1,301.00 Crore year on year, a rise of 5.23%.

- Total Expenses for Q2FY24 of ₹1,290.00 Crores up from ₹1,155.00 Crores year on year, a rise of 11.69%.

- Consolidated Net Profit of ₹97.00 Crores down 26.52% from ₹132.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹1.47, down 26.13% from ₹1.99 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.