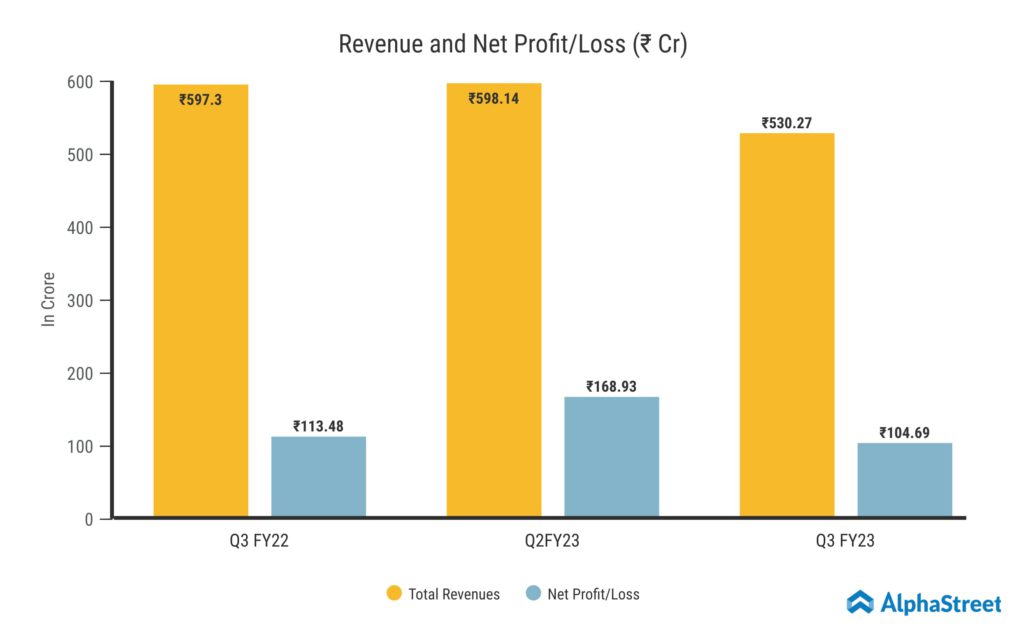

HEG Limited (NSE: HEG) is one of the largest graphite electrode producers in the world, and its products are used by steel companies across the globe. The company has a strong reputation for quality and innovation, and it has been able to maintain a strong market position in the face of increasing competition. HEG’s net profit fell 7.75% to ₹104.69 crore down from ₹113.48 crore in the same quarter previous year. Revenue from operations dropped 11.22% to ₹530.27 crore in the quarter that ended in December 2022 from ₹597.30 crore in the Q3 FY22. This quarter’s earnings per share was ₹27.13.

The Graphite segment of the company generated a total of ₹516.01 Crore in revenue. The core market segment fell by 11.6% from the previous year down to ₹584.02 Crore.