Company Overview:

Bharti Airtel Ltd is one of the world’s leading providers of telecommunication services with presence in 18 countries representing India, Sri Lanka, 14 countries in Africa.

Financial Results:

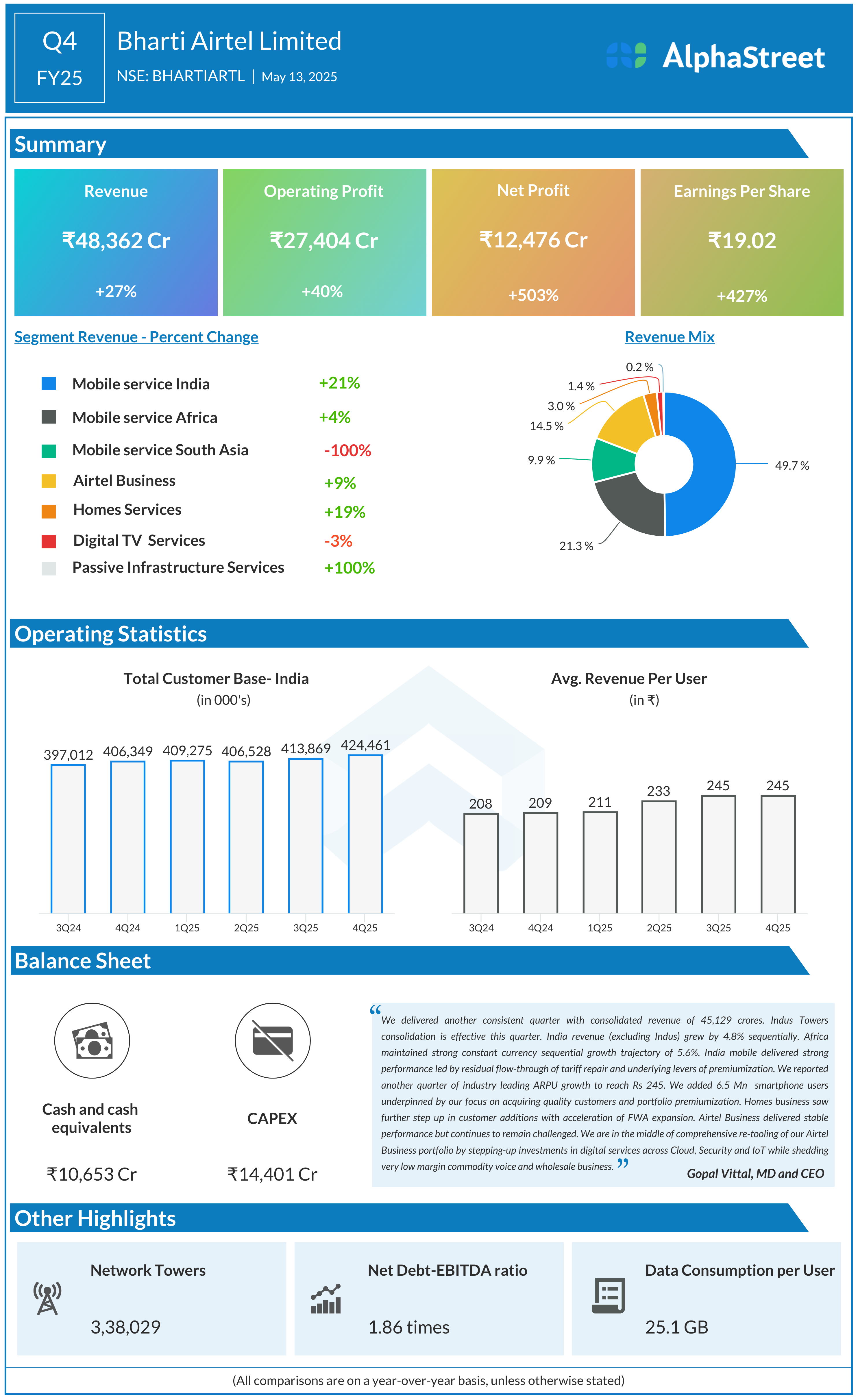

Bharti Airtel reported Total revenue for Q4FY25 of ₹ 48,362 Crore up from ₹37,916 Crore in Q4FY24, a rise of 27% y-o-y.

Total Expense for Q4FY25 of ₹27,404 Crore up from ₹18,234 Crore in Q4FY24, a rise of 40% y-o-y.

Net Profit of ₹12,476 Crore up 503% from ₹2,068 Crore in Q4FY24.

Earnings per Share is ₹19.04, up 427% from ₹3.61 in Q4FY24.