Dr. Reddy’s Laboratories Limited is an Indian multinational pharmaceutical company with a presence in over 25 countries. It was founded in 1984 and has its headquarters in Hyderabad, India. Dr. Reddy’s is a research-driven company with a focus on developing and manufacturing high-quality pharmaceutical products. The company operates in three main segments: Global Generics, Pharmaceutical Services and Active Ingredients (PSAI), and Proprietary Products.

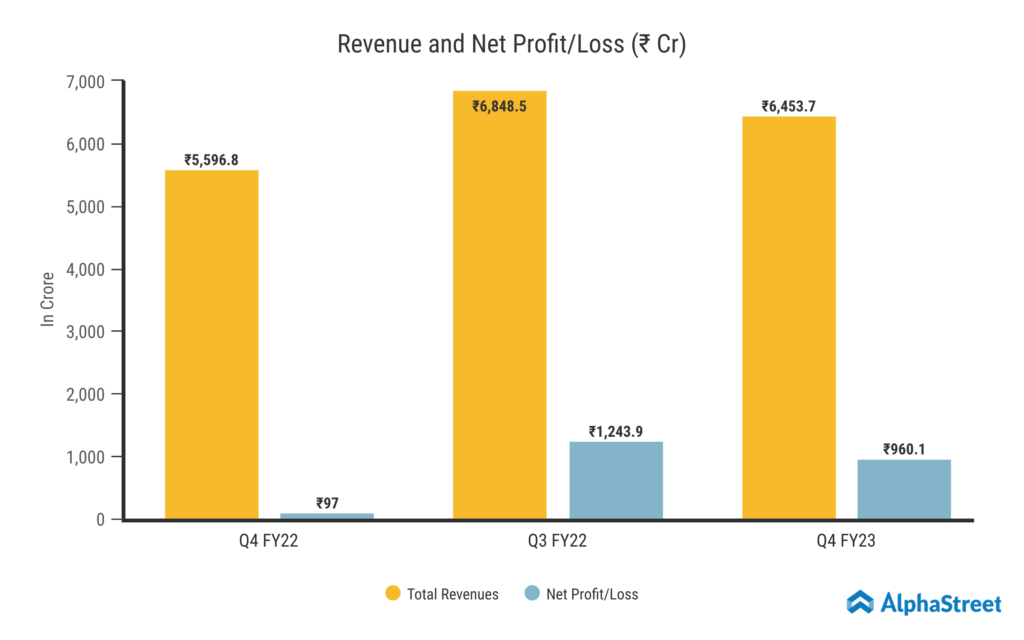

- Dr. Reddy’s Laboratories Limited reported Total Income for Q4 FY23 of ₹6,453.7 Crore up from ₹5,596.8 Crore year on year, a growth of 15.3%.

- Total Expenses for Q4 FY23 of ₹5,132.2 Crore down from ₹5,348.4 Crore.

- Consolidated Net Profit of ₹960.1 Crore, surged from ₹97 Crore in the same quarter of the previous year.

- The Earnings per Share is ₹57.68, from ₹5.83 in the same quarter of the previous year.