HEG Ltd is a leading manufacturer and exporter of graphite electrodes in India. It operates the largest single-site integrated graphite electrodes plant in the world.

Financial Results:

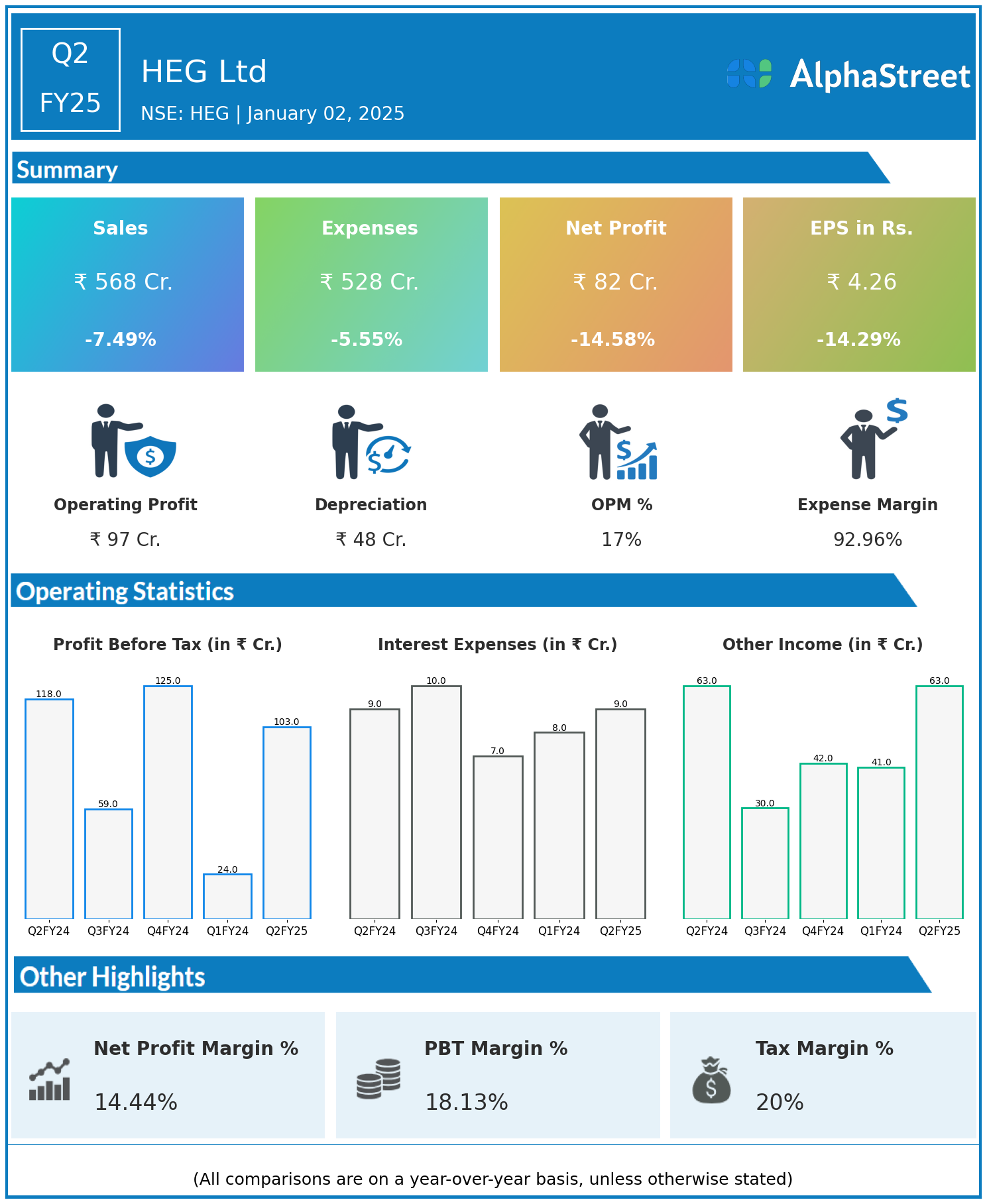

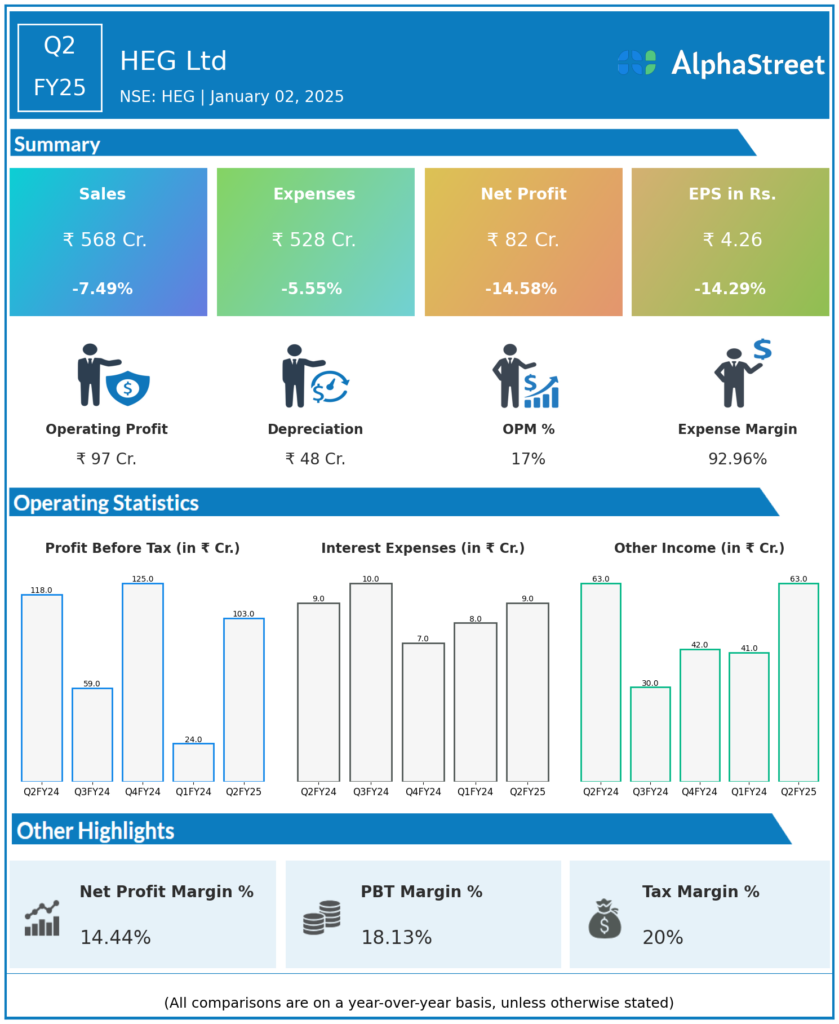

HEG Ltd reported Revenues for Q2FY25 of ₹568.00 Crores down from ₹614.00 Crore year on year, a fall of 7.49%.

Total Expenses for Q2FY25 of ₹528.00 Crores down from ₹559.00 Crores year on year, a fall of 5.55%.

Consolidated Net Profit of ₹82.00 Crores down 14.58% from ₹96.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹4.26, down 14.29% from ₹4.97 in the same quarter of the previous year.