Jubilant Ingrevia is a provider of integrated global life science products and innovative solutions. We cater to customers in the pharmaceutical, nutrition, agrochemical, consumer, and industrial sectors with specialised products and services that are creative, practical, and up to the highest standards of quality.

Additionally, Jubilant Ingrevia offers specialised bespoke research and production services for customers in the pharmaceutical and agrochemical industries.

Financial Results:

- Jubilant Ingrevia Limited reported Total Income for Q4FY23 of ₹ 1,154 Crores down from ₹ 1,305 Crore year on year, a fall of 12%.

- Total Expenses for Q4FY23 of ₹ 1,078 Crores up from ₹ 1,190 Crores year on year, fall of 9%.

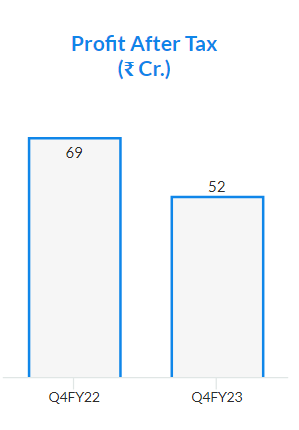

- Consolidated Net Profit of ₹ 52 Crores, down 24% from ₹ 69 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹ 3.19, down 26% from ₹ 4.30 in the same quarter of the previous year.