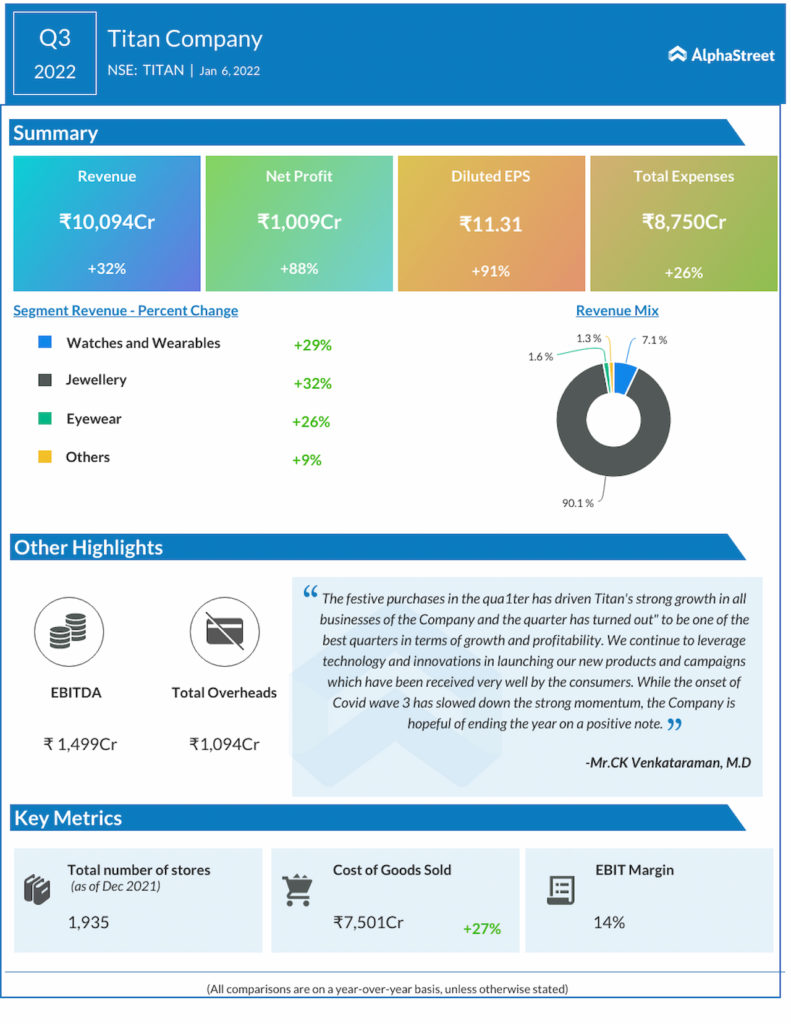

Titan Company (NSE: TITAN) reported its third-quarter 2022 earnings results.

The company had a consolidated revenue of ₹10,094 crores with a growth of 32% year on year.

Titan enjoyed a net profit of ₹1,009 crores or ₹11.31 per share compared to ₹537 crores or ₹5.92 per share in the same quarter of the previous year.