3M India Ltd, a diversified subsidiary of the US-based 3M Company, delivered a robust Q2 FY26 performance, with double-digit profit and revenue growth driven by all business segments and improved cost management.

Financial Highlights

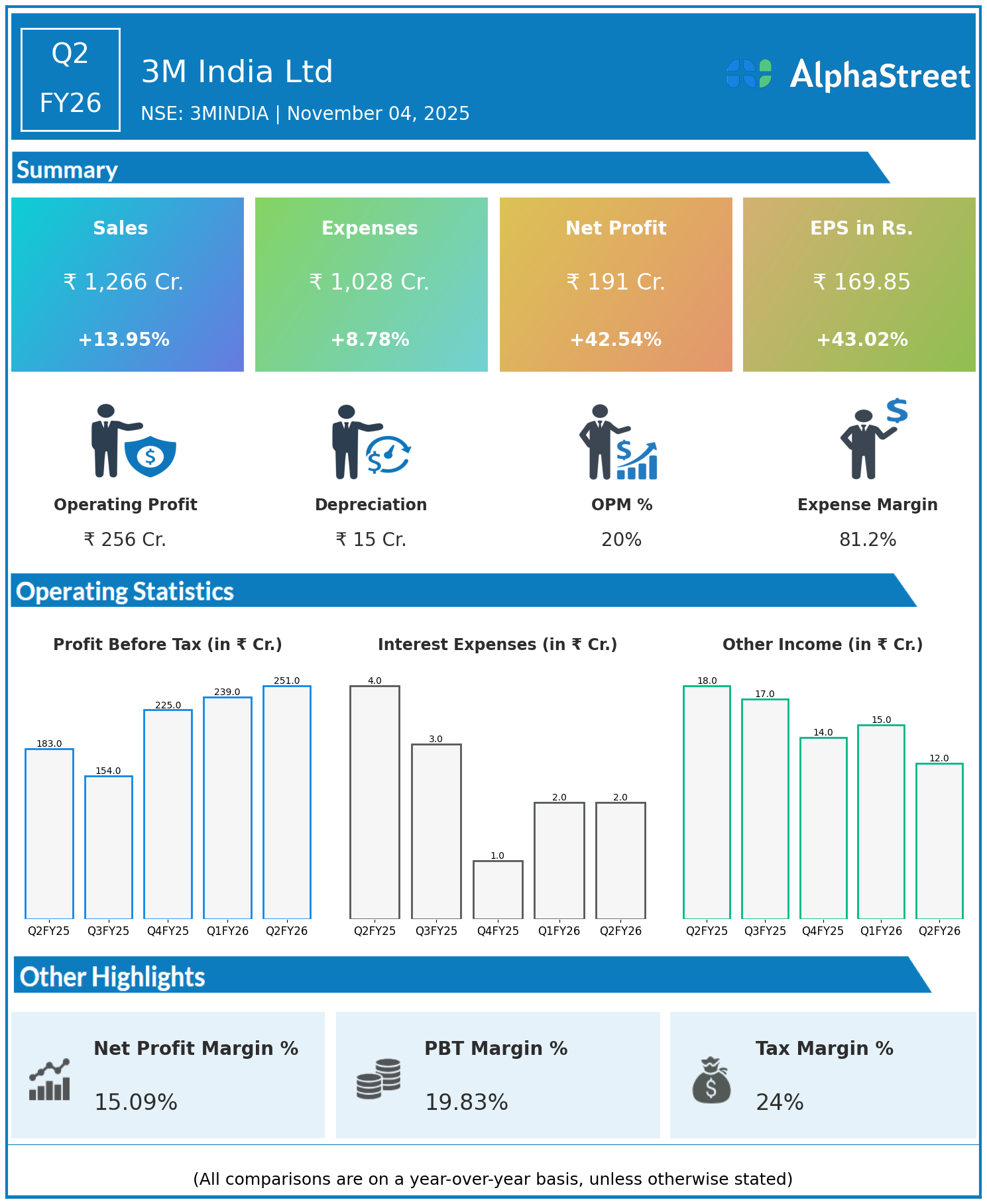

- Revenues rose 13.95% year on year to ₹1,266 crore from ₹1,111 crore.

- Total expenses increased 8.78% to ₹1,028 crore from ₹945 crore.

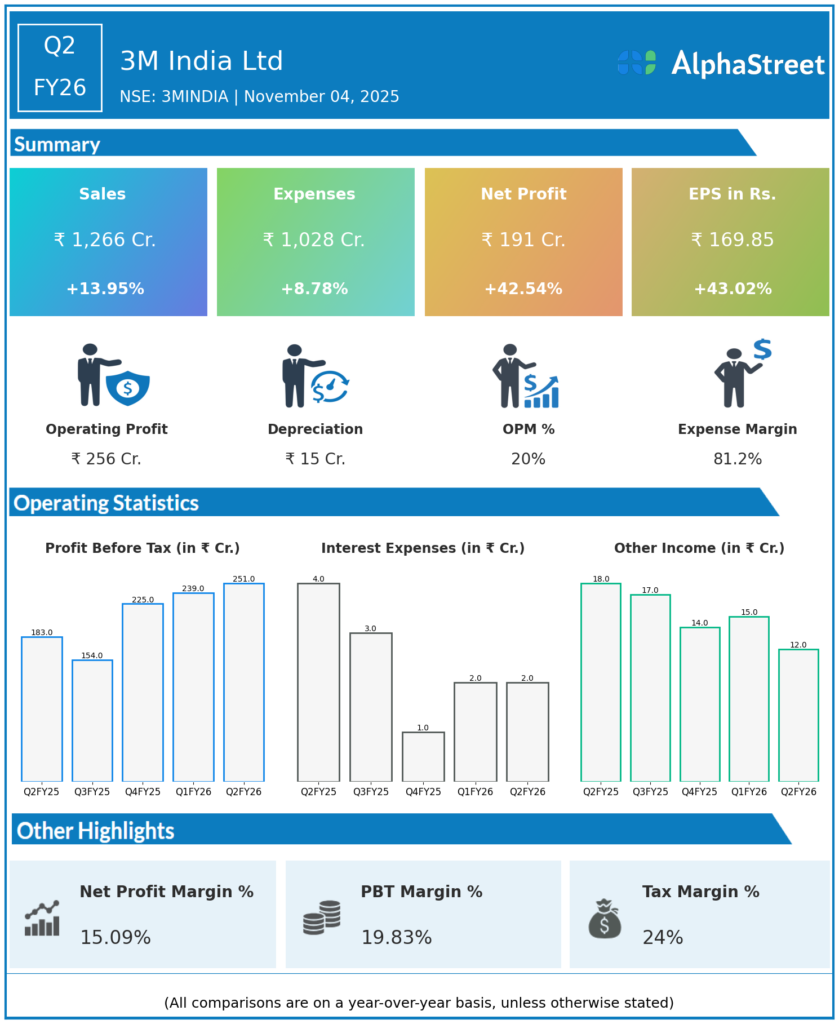

- Consolidated net profit jumped 42.54% to ₹191 crore from ₹134 crore last year.

- Earnings per share (EPS) improved 43.02% to ₹169.85 from ₹118.76.

Key Business Drivers

- EBITDA grew 33% YoY to ₹268 crore, led by margin expansion on improved product mix and lower input cost inflation.

- All four business segments posted double-digit sales growth: Healthcare (+14.9%), Consumer (+14.6%), Transportation & Electronics (+12.9%), and Safety & Industrial (+12.3%).

- Management highlighted broad-based demand recovery, especially in autos, healthcare, and infrastructure safety.

- Higher spending on sales and marketing was maintained to deepen market penetration.

- The quarter saw the appointment of a new Independent Director and statutory auditors.

Outlook

Analysts expect cyclical tailwinds from autos, GST-related benefits, and government-led infra spending to support healthy growth in H2 FY26. Management remains optimistic about sustaining margins and top-line momentum, with further product innovation and expansion of the business mix.

3M India’s Q2 FY26 results showcase operational excellence, strong market execution, and resilience across its core B2B and B2C verticals.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.