3M India Ltd, a subsidiary of 3M Company, USA, operates across four major segments: Safety & Industrial, Transportation & Electronics, Health Care, and Consumer. The company has manufacturing facilities in Ahmedabad, Bangalore, and Pune, along with a Research & Development center in Bangalore. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

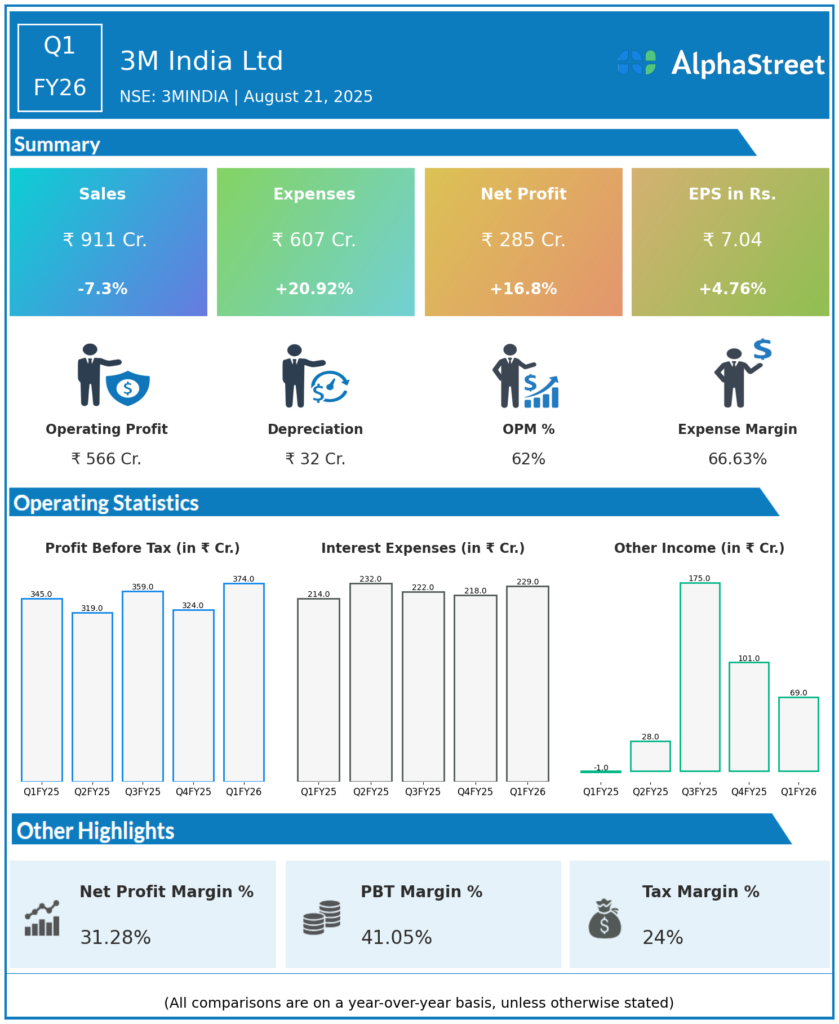

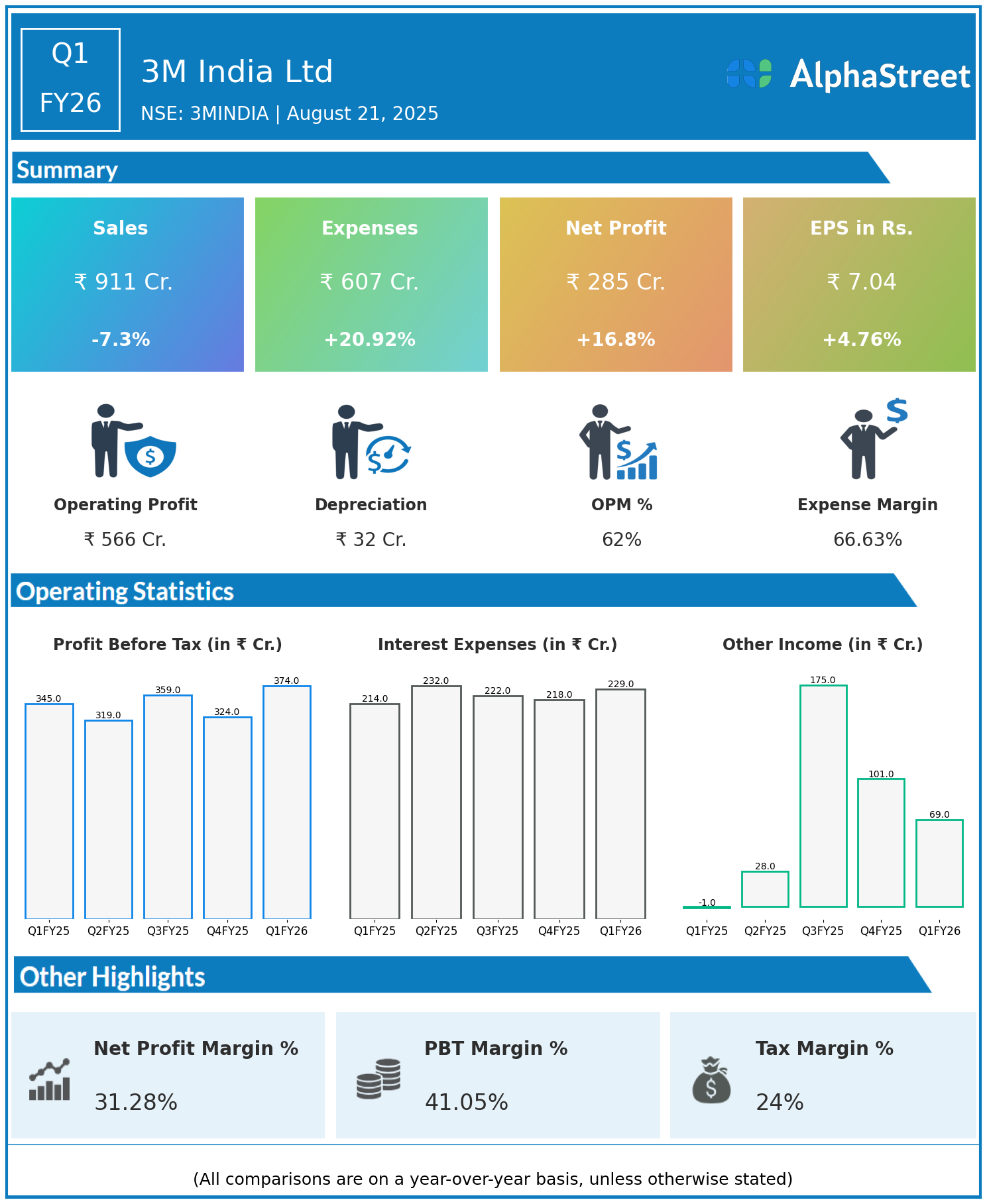

- Revenue: ₹911 crore, down 7.3% year-on-year (YoY) from ₹1,047 crore in Q1 FY25.

- Total Expenses: ₹607 crore, up 20.92% YoY from ₹502 crore.

- Consolidated Net Profit (PAT): ₹285 crore, up 16.8% from ₹244 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.04, up 4.76% from ₹6.72 YoY.

Operational & Strategic Update

- Revenue Decline: Revenues fell by 7.3% due to soft demand across key segments and a challenging macroeconomic environment.

- Rising Expenses: Total expenses rose sharply by nearly 21%, driven by increased input costs, higher operating expenses, and investments in R&D and marketing.

- Strong Profit Growth: Despite revenue decline and higher expenses, net profit grew significantly by nearly 17%, indicating strong margin improvement and operational efficiencies.

- Segment Diversity: The company’s diversified portfolio across industrial safety, healthcare, transportation, and consumer products helps moderate business volatility.

- Strategic Focus: 3M India continues to focus on innovation, product portfolio expansion, and deepening market penetration in key sectors.

Corporate Developments in Q1 FY26 Earnings

The quarter Q1 FY26 indicates effective cost management and strategic execution, as 3M India managed to grow profits despite top-line challenges.

Looking Ahead

3M India Ltd aims to strengthen its market position by investing in new technologies, enhancing product innovation, and leveraging its integrated supply chain. Focused efforts on margin expansion and sustainable growth are expected to continue through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.