The results for this quarter were in-line with our expectations. Despite macroeconomic uncertainty and furloughs in the quarter, we grew our revenue by 10% on a year-on-year basis. Our EBITDA margin is inching towards breakeven led by our focused cost rationalization strategy. We continue to remain focused on expanding our Edge computing capabilities, with the recent deal win of the RailTel WiFi Monetization Project being a key trigger to accelerate the momentum. While we see some macro issues and general weakness in the overall market, the demand environment continues to remain stable for us. The Company is slowly but surely transitioning to a services led portfolio offering with a focus on high growth and stable margins in the quarters to come. – Mr. Thompson P. Gnanam, Managing Director and Global CEO

Stock Data:

| Ticker | NSE: 3IINFOLTD & BSE: 532628 |

| Exchange | NSE & BSE |

| Industry | SOFTWARE & SERVICES |

Price Performance:

| Last 5 Days | -8.63% |

| YTD | -22.56% |

| Last 12 Months | -49.36% |

Company Description:

3i Infotech Limited is a digital transformation company headquartered in Mumbai, India, with over 5600 employees in 30 offices across 4 continents. The company has expertise in various industry verticals, including BFSI, Healthcare, Manufacturing, Education, Telecom, Media & Entertainment, Retail and Government sectors. The company offers a range of IT services and solutions, including 5G in Edge Computing, Cognitive AI/ML, Data Science and Analytics, and Blockchain. 3i Infotech has successfully transformed the business operations of more than 1,200 customers across 50 countries. The company has a strong presence and client base in geographies like North America, India, Asia Pacific, Middle East, and Kingdom of Saudi Arabia.

Critical Success Factors:

- 3i Infotech Limited has set a goal to be a billion-dollar company by 2030, and it has grand global strategies to help it reach this goal. The company is optimizing its traditional businesses, getting more business from existing customers with the same offering, and adding new offerings and locations. The company has done restructuring at a global organization, eliminating non-profitable engagements, and rationalizing costs in terms of every asset, including infrastructure, people, and all other assets that need to be rationalized. The company will also be investing in new lines of businesses that offer 5G technology offerings, such as edge computing, cloud, edge analytics, edge application, or security.

- The company has several build products and platforms in progress that will be the future guidance in building an edge-ready organization. NuRe Edge facet product is now successfully launched and generating revenues for the company. The company is also working with its telco partners in Asia to drive B2B and B2B2C strategies, which are important levers to accelerate revenues beyond traditional B2B services and help achieve the billion-dollar goal. NuRe velocity, which was launched in November, is also starting to generate revenue and is focused on the mid-market to SMB segments. The company is progressing in the US mortgage industry with its pilots and prototypes and is nearly close to commercial engagement in cognitive document management solutions.

- Furthermore, 3i Infotech has a keen focus on emerging industry verticals such as EdTech, Agritech, and Greentech, in addition to its focus on BFSI, manufacturing (SMB and midmarket), retail, telecom, media, and entertainment sectors. With its substantial initiative and directives in tech, such as the launch of the first-ever Zero-Trust Sovereign Cloud in Malaysia and the unveiling of its first Centre of Excellence in Tirunelveli, the company is poised for significant growth in the coming years.

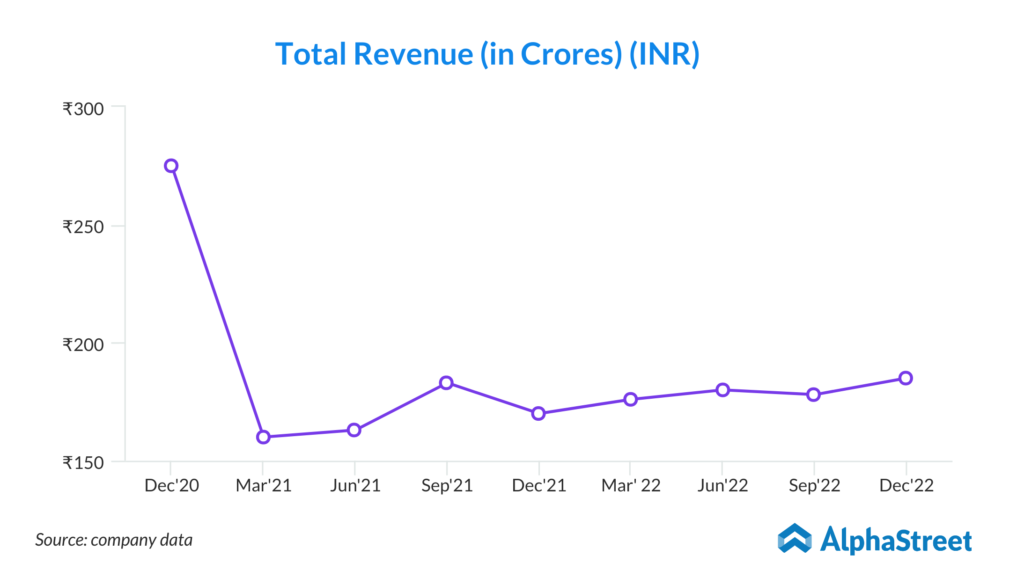

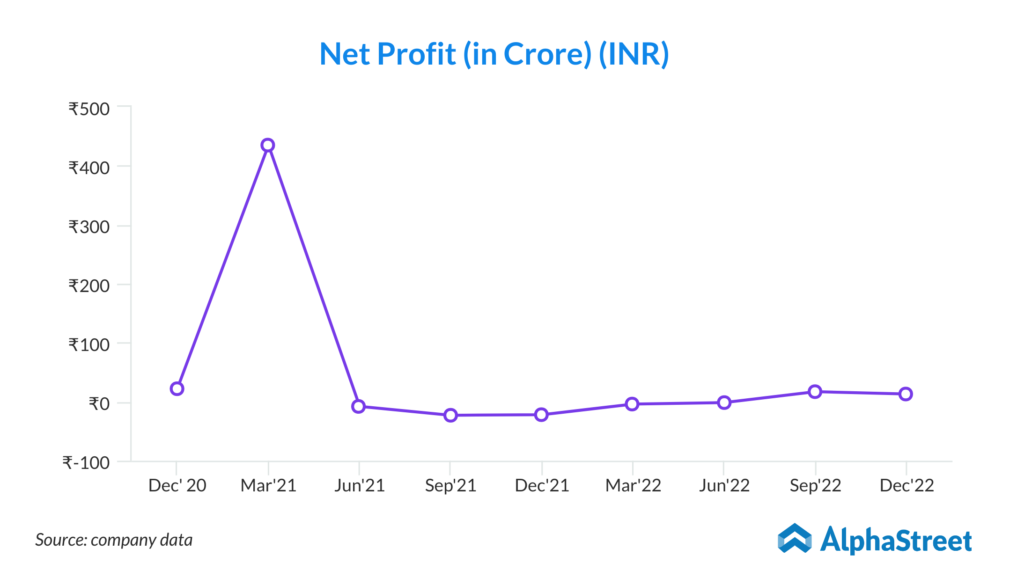

- 3i Infotech Limited has shown steady growth in the third quarter, with a quarter-on-quarter growth of 2.9% to INR182.3 crores and a gross margin of 12.7%. The company’s grow and build strategies are starting to bear fruit as the revenue mix shifts from classic enterprise business to next-generation business. The company’s focus is on the new digital segment, NuRe, which has reported INR39.3 crores with a high gross margin of 26.6%. With 39 new logos on-boarded in this quarter, the company has a potential order book of almost INR100 crores for the next financial year, which will help to change the revenue mix.

- 3i Infotech’s revenue mix is also set to shift from classic enterprises to the next generation business, which will help them to achieve their target of US$ 1 Bn by 2030 by acting upon its Run, Grow & Build Model. Moreover, the company has made significant strides in securing key deals from both private and public enterprises, such as the Rs 250 crore WiFi monetization project by RailTel Corporation of India Limited over the next 5 years and a mega contract from Eureka Forbes for three years of DIMS services.

- The company has also made impressive gains in its business operations, with Q3 FY23 Revenues for the Global Business Region reaching Rs.109.8 crore, and has grown QoQ by 1.6%. The Application-Automation-Analytics (AAA) segment was one of the highest revenue contributors with Rs 131.4 crore, followed by Infrastructure Management Services revenues of Rs 23.7 crore. The company’s revenue growth in the India region has also been impressive, with a YoY increase of 35.2% and QoQ growth of 5.2%, reaching Rs.67.3 crore.

Key Challenges:

- 3i Infotech Limited faces several risks and concerns that could affect its performance and growth prospects. The first major risk is the company’s high debt levels, which have been increasing in recent years. As of FY2020, the company had a total debt of INR 842.17 crore, which was nearly double its net worth. Such high levels of debt could limit the company’s ability to invest in growth opportunities or fund working capital requirements, and increase its vulnerability to interest rate fluctuations.

- Another concern for 3i Infotech Limited is its heavy dependence on a few key customers. As per its annual report for FY2020, the top 10 customers accounted for 50% of the company’s revenue. This concentration of revenue increases the risk of losing significant revenue if any of these customers decide to reduce their business with the company. Moreover, if any of these customers face financial difficulties or go bankrupt, it could have a cascading effect on the company’s financials.

- 3i Infotech Limited also faces competition from larger and established players in the IT services and software industry. The company operates in a highly competitive environment, where technological advancements and changing customer demands require continuous innovation and upgradation of services. Failure to keep up with these trends could lead to a loss of market share and revenue.

- Finally, 3i Infotech Limited faces risks related to data security and privacy. As a provider of IT services, the company has access to sensitive data belonging to its clients. Any breaches of this data could lead to reputational damage and legal liabilities. The company will need to invest in robust cybersecurity measures and ensure that its employees are trained to handle data securely. Additionally, the company will need to comply with data privacy regulations in the countries where it operates to avoid penalties and legal risks.

- In conclusion, 3i Infotech Limited faces several risks and concerns that could impact its growth and profitability. These risks include competition, economic conditions, and data security and privacy. The company will need to continually innovate and invest in new technologies to stay ahead of the competition, maintain a diversified client base, and implement hedging strategies to manage currency risk. Additionally, the company will need to invest in robust cybersecurity measures and ensure that its employees are trained to handle data securely while complying with data privacy regulations in the countries where it operates. By addressing these risks, 3i Infotech Limited can mitigate potential impacts and continue to grow its business.