360 ONE WAM Ltd (formerly IIFL Wealth Management Limited), established in 2008, is one of India’s largest private wealth management firms, offering financial product distribution, advisory, and portfolio management services primarily to high net worth individuals. Presenting below are its Q1 FY26 Earnings Results.

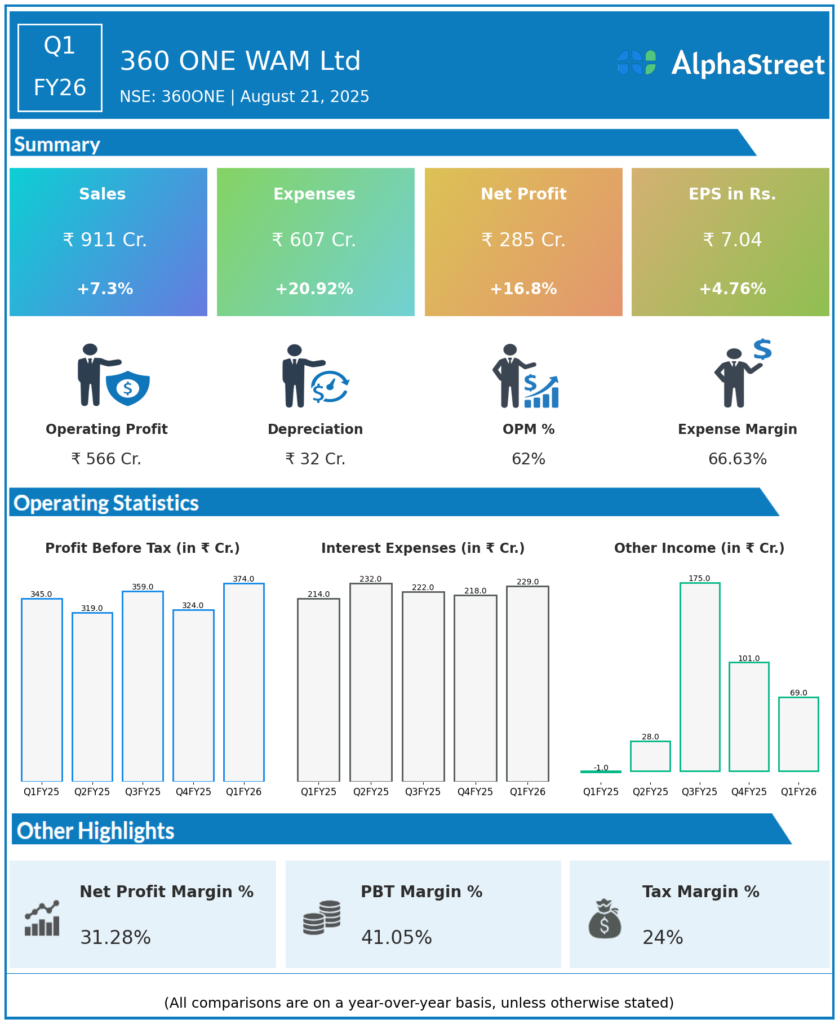

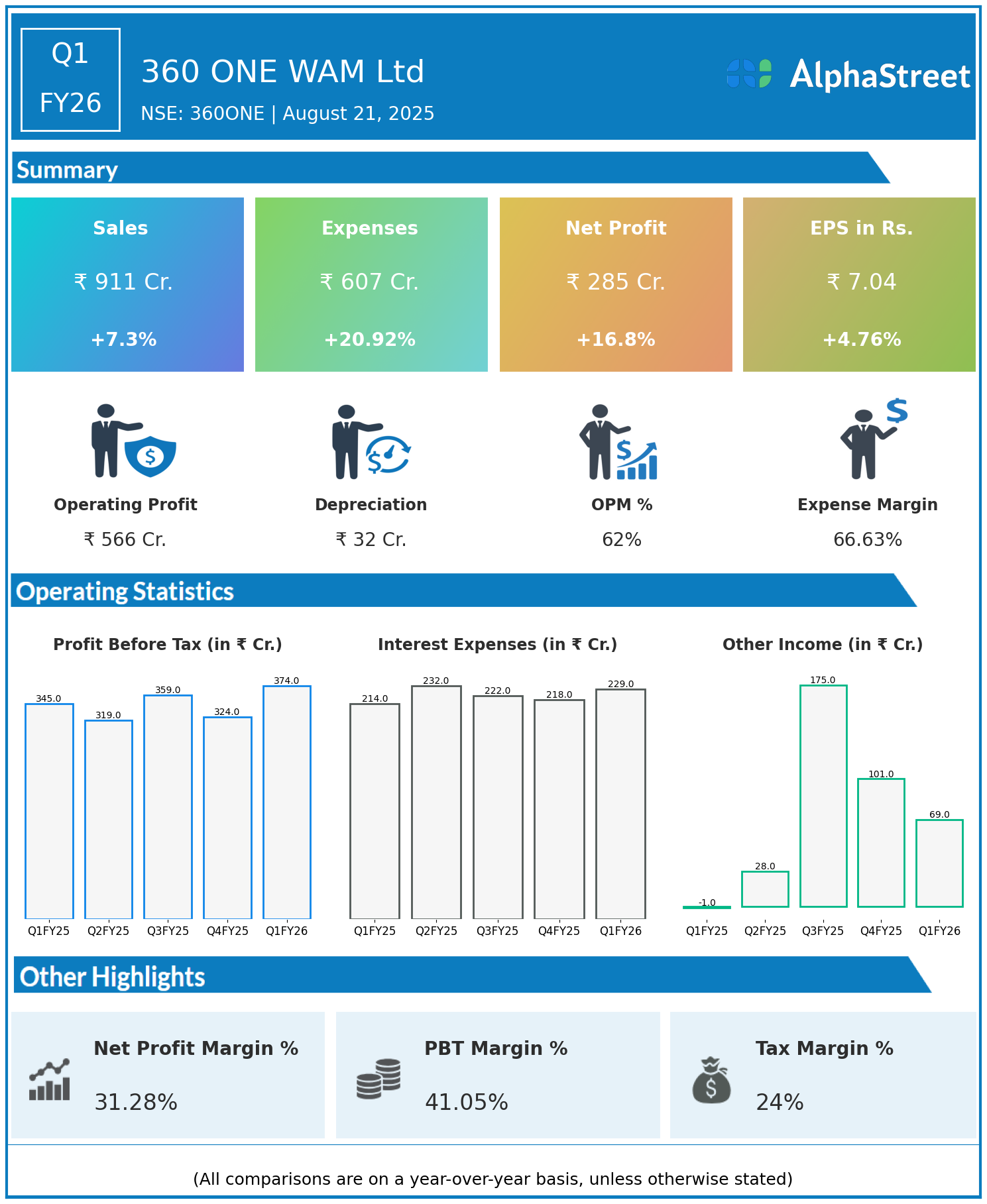

Q1 FY26 Earnings Results

- Revenue: ₹911 crore, up 7.3% year-on-year (YoY) from ₹849 crore in Q1 FY25.

- Total Expenses: ₹607 crore, up 20.92% YoY from ₹502 crore.

- Consolidated Net Profit (PAT): ₹285 crore, up 16.8% from ₹244 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.04, up 4.76% from ₹6.72 YoY.

Operational & Strategic Update

- Revenue Growth: Revenue climbed by over 7%, reflecting strong client asset mobilization, increased distribution income, and steady demand for portfolio management and advisory offerings.

- Expense Surge: Total expenses grew by nearly 21%, primarily due to higher staff costs, technology investment, and ongoing business expansion.

- Improved Profitability: Net profit jumped nearly 17%, while EPS advanced almost 5%, indicating operational leverage and a positive business mix.

- Market Leadership: 360 ONE WAM continues to be a leading player in wealth management, underpinned by its diversified product suite, trusted advisory, and expanding client base.

- Strategic Focus: The firm remains focused on enhancing technology platforms, expanding services for high net worth and institutional clients, and further strengthening brand positioning.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results underline robust profit momentum for 360 ONE WAM Ltd, driven by resilient top-line growth and disciplined business management despite rising costs.

Looking Ahead

360 ONE WAM Ltd aims to consolidate leadership through innovation in wealth solutions, enhanced digital capabilities, and deeper client engagement. Continued focus on broadening services and operational excellence is expected to drive sustainable growth through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.