Data

Access AlphaStreet’s high quality, time-sensitive and accurate information that will help you find Alpha. Our API’s simplify how you can partake and use the information.

High

quality

time-sensitive and accurate

financial data to find Alpha

Audio

synced with Live and Archived

transcript streaming

Institutional

quality data

vetted by our experienced

analysts

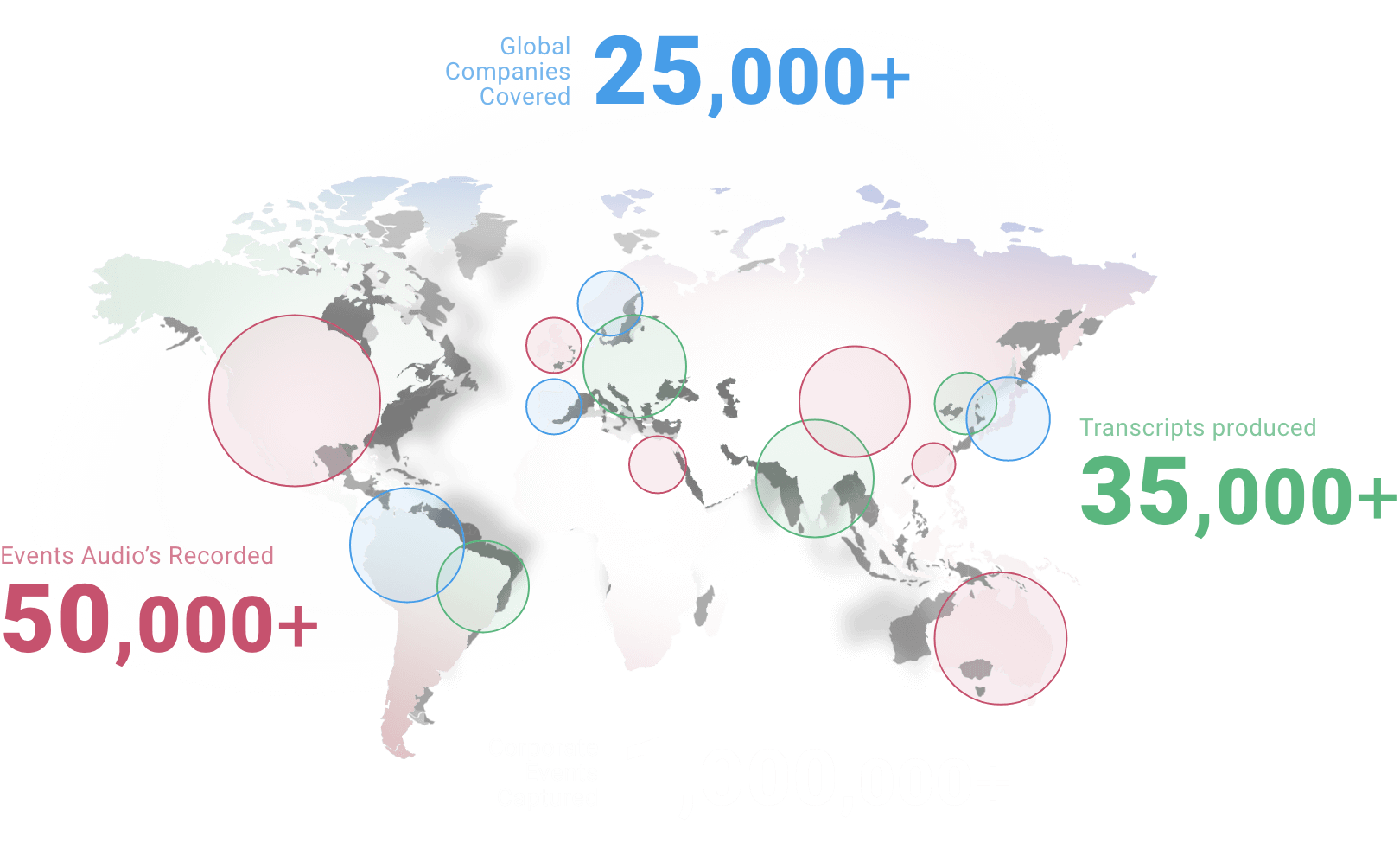

Global

coverage

one stop hub

Events & Corporate

Actions Calendar

Industry's most accurate corporate events data, powered by AI.

40+

event types tracked

AI/NLP

friendly metadata structure

Extensive

historical data

API

delivery

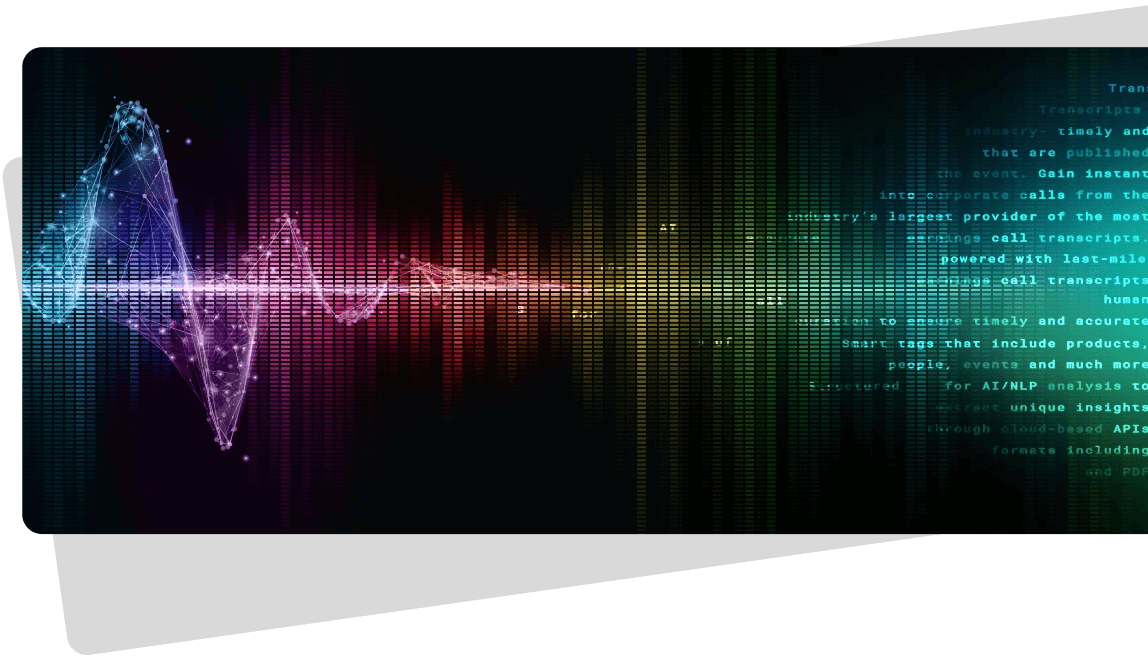

Transcripts

World’s largest and most accurate earnings

and other conference call transcript

Live streaming

Smart tagged

Industry best TAT

Audio synced

AlphaGraphs

Visually compelling and easy to digest for

insights into companies, competition and

industries.

Research

Unbiased research for coverage initiation or generating

investment ideas. Combine our research with our data

to get insights to make informed decisions.

CxO & Experts

interviews

If you are a CxO, tell the investors your story or if

you are a subject matter expert(SME), share your

expertise.

Who uses us

Global public companies

Hedge funds and Quant Funds

Portfolio managers and Asset managers

Financial Institutions

Business intelligence firms